-

High surge currents have met their match in our 2200V rectifier, GP12022. This high-voltage standard recovery rectifier is designed for demanding industrial applications and harsh conditions.

With impressive features, including a forward current capability of 120A and a low forward voltage of 1.2V, this component maximizes efficiency in power conversion while minimizing energy losses.

MCC’s rectifier utilizes the compact yet powerful TO-264P package with a high creepage 2-pin design to ensure safety and reliability. Thermal performance and efficiency are built in, with the ability to easily be mounted on a heatsink for optimal heat dissipation and streamlined installation.

All these features add up to superior operation you can count on in harsh environments. But GP12022 is actually eco-friendly thanks to RoHS compliance, a lead-free finish, and halogen-free design.

Level up your high-voltage industrial designs with the MCC’s 2200V standard recovery rectifier.

Features & Benefits:

- High forward surge current capability excels in demanding conditions

- Low forward voltage minimizes energy losses

- High creepage 2-pin TO-264P package enhances safety

- Ideal for high-temp applications

- Easy mounting to heatsink for faster installation

- Excellent thermal properties

- Halogen-free with lead-free finish

- RoHS compliant

Original – Micro Commercial Components

-

LATEST NEWS / PRODUCT & TECHNOLOGY / Si2 Min Read

Magnachip Semiconductor Corporation announced that the Company released its 6th-generation 600V Super Junction Metal Oxide Semiconductor Field Effect Transistor (SJ MOSFET) enhanced with microfabrication technology.

This 6th-generation 600V SJ MOSFET (MMD60R175S6ZRH) was built on the 180nm microfabrication process and Magnachip’s latest design technology. This sophisticated technology improves upon the previous generation of SJ MOSFETs by narrowing the cell-pitches by 50% and lowering the RDS(on) (On resistance: the resistance value between the drain and the source of MOSFETs during on-state operation) by 42%. As a result, this product comes in the same Decawatt Package (DPAK), while offering the low RDS(on) of 175mΩ and outstanding power density.

Furthermore, the total gate charge is lowered by approximately 29% compared to the previous generation, resulting in reduced switching loss and enhanced power efficiency. The power efficiency is in fact one of the key features of this product, as it gives product designers flexibility with regards to various applications. In addition, a Zener diode is embedded between the gate and the source to strengthen the ruggedness and reliability of the MOSFET in an application and prevent it from sustaining damage caused by external surges or electrostatic discharges.

With its high efficiency, flexible design and reliability, this new 600V SJ MOSFET can be used in a wide range of applications, such as servers, OLED TVs and laptop fast chargers. Omdia, a global market research firm, estimates that worldwide server shipments will grow by 8% annually from 2023 to 2027, while global OLED TV shipments will increase 11% every year, reaching a total of 9.3 million units in 2027.

“Following the launch of this MOSFET, Magnachip plans to unveil additional 6th-generation SJ MOSFETs, including those with a fast recovery body diode, in 2024,” said YJ Kim, CEO of Magnachip. “Aligned with customer demand, our technical innovation will further strengthen our industry presence and global market penetration.”

Original – Magnachip Semiconductor

-

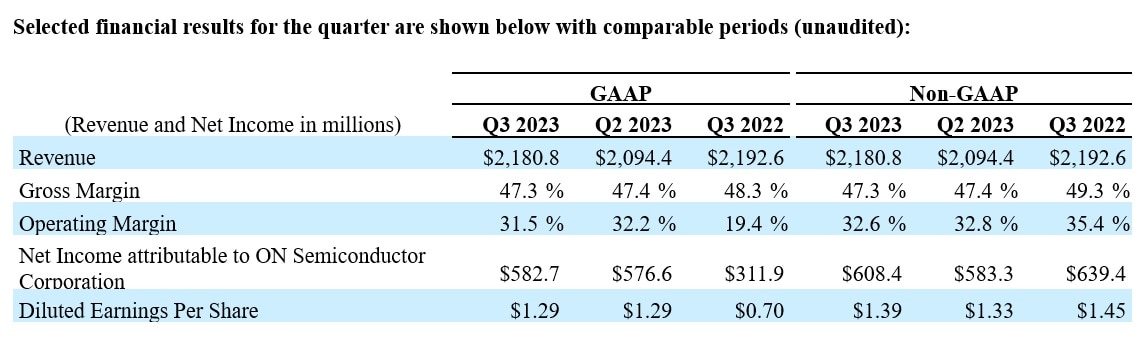

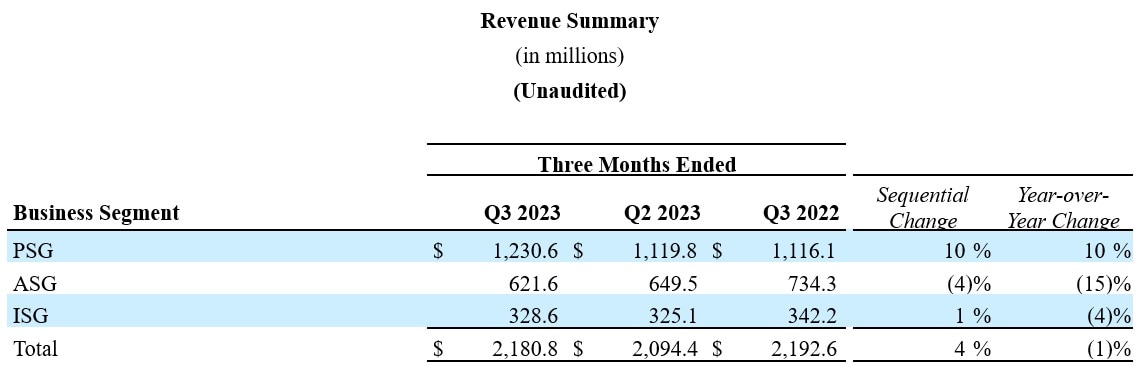

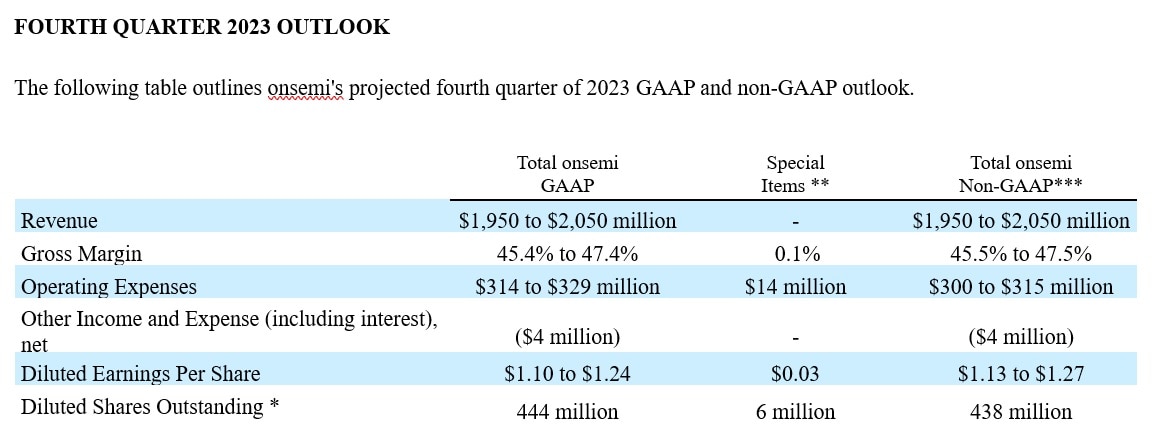

onsemi announced results for the third quarter of 2023 with the following highlights:

- Revenue of $2,180.8 million; GAAP and non-GAAP gross margin of 47.3%

- GAAP operating margin and non-GAAP operating margin of 31.5% and 32.6%, respectively

- GAAP diluted earnings per share and non-GAAP diluted earnings per share of $1.29 and $1.39, respectively

- Record automotive revenue of $1.2 billion, and increased 33% year-over-year

- Record industrial revenue of $616 million, up slightly year-over-year

“Our disciplined approach and execution resulted in another solid quarter, demonstrating the resilience in our business amid market softness,” said Hassane El-Khoury, president and chief executive officer, onsemi.

“We continue to drive structural improvements and efficiencies, most notably in our silicon carbide operation, with the completed expansion of the world’s largest, state-of-the-art silicon carbide fab in South Korea for 150- and 200-millimeter wafers.”

Original – onsemi

-

JCET Group announced its financial results for the third quarter of 2023. The financial report shows that in the third quarter, JCET achieved revenue of RMB 8.26 billion, an increase of 30.8% quarter-on-quarter, and net profit of RMB 0.48 billion, an increase of 24% quarter-on-quarter.

JCET has focused on key applications of advanced packaging this year, continuously enhancing its overall solution capabilities for application scenarios, optimizing production capacity layout, and further strengthening its leading position in the global IC packaging and test industry.

JCET has achieved innovative breakthroughs in markets such as automotive electronics, 5G communications, high-performance computing (HPC), and wide bandgap power devices. Seizing market opportunities driven by the acceleration of the electric vehicle market, JCET’s automotive electronics business has maintained rapid growth.

In the first three quarters of this year, the company’s automotive electronics revenue increased by 88% year-on-year. In the 5G communications-related market, JCET provided global customers with services in R&D and HVM, further solidifying its leading position in areas including Antenna in Package (AiP) modules, RF power amplifiers (PA), and radio frequency front end (RFFE) modules.

Leveraging high-density heterogeneous SiP technologies and advantageous global production layouts, JCET intensifies its efforts with customers in AI and HPC domains for advanced packaging solutions development and product introductions, accelerating market expansion in high-computation systems, power management, high-performance storage, and smart terminals.

In the power semiconductor market, the high-density integration solutions developed by JCET in collaboration with global customers on wide bandgap power devices are widely used in the automotive and industrial energy storage, with ongoing production capacity expansion.

JCET continues to enhance its technological innovation, with R&D investment of RMB 1.08 billion in the first three quarters of 2023, a year-on-year increase of 10.4%. The company continues to promote the construction of high-performance packaging production capacities and upgrade existing factories towards advanced packaging technologies. In addition, JCET improves lean production capabilities, strengthens inventory control and supply chain management, and ensures that the company’s operations remain highly efficient.

Q3 2023 Financial Highlights:

- Revenue was RMB 8.26 billion, an increase of 30.8% quarter-on-quarter

- Net profit was RMB 0.48 billion, an increase of 24% quarter-on-quarter

- Earnings per share was RMB 0.26

Q3 YTD 2023 Financial Highlights:

- Revenue was RMB 20.43 billion

- Net profit was RMB 0.97 billion

- Earnings per share was RMB 0.54

Original – JCET

-

Toshiba Electronic Devices & Storage Corporation (“Toshiba”) has launched two products of 600V small intelligent power device (IPD) for brushless DC motor drive applications such as air conditioners, air cleaners, and pumps. Volume shipments of “TPD4163K” and “TPD4164K,” which have output current (DC) ratings of 1A and 2A, respectively, start today.

Both new products are housed in a through hole type HDIP30 package, which reduces the mounting area by approximately 21% against Toshiba’s previous products. This helps reduce the size of motor drive circuit boards.

As power supply voltage may fluctuate significantly in regions with unstable power supply, the voltage has been increased from the 500V of Toshiba’s previous products[1] to 600V, which improves reliability.

A “Reference Design for Sensorless Brushless DC Motor Drive Circuit” that utilizes the functions of the new TPD4164K with a TMPM374FWUG microcontroller with vector control engine is available from today on Toshiba’s website.

Toshiba will continue to expand its product line-up with improved characteristics, to improve design flexibility, and to contribute to carbon neutrality through energy-saving motor control.

Applications

Brushless DC motors in home appliances

- Fan motors (air conditioner, air cleaner, ventilation fan, ceiling fan, etc.)

- Pumps

Features

- High power supply voltage rating to secure operation margin for power supply voltage fluctuations: VBB=600V

- Small package

Through hole type HDIP30: 32.8mm×13.5mm (typ.), t=3.525mm (typ.)

Original – Toshiba

-

Fuji Electric published FY2023 1H Financial Results. In the semiconductor business, the company’s net sales increased year on year due to growth in demand for power semiconductors for electrified vehicles (xEVs).

The growth in sales led to operating results being relatively unchanged year on year, despite the rise in expenses for bolstering power semiconductor production capacity and the increases in material costs.

- Net sales: ¥51.1 billion (up 11% year on year)

- Operating profit: ¥7.1 billion (unchanged year on year)

Original – Fuji Electric

-

STMicroelectronics N.V. reported U.S. GAAP financial results for the third quarter ended September 30, 2023. ST reported third quarter net revenues of $4.43 billion, gross margin of 47.6%, operating margin of 28.0%, and net income of $1.09 billion or $1.16 diluted earnings per share.

Jean-Marc Chery, ST President & CEO, commented:

- “Q3 net revenues of $4.43 billion came in above the midpoint of our business outlook range, and Q3 gross margin of 47.6% was slightly above guidance.”

- “Q3 net revenues increased 2.5% year-over-year. As expected, the revenue performance was driven mainly by continued growth in Automotive, partially offset by lower revenues in Personal Electronics.”

- “On a year-over-year basis, gross margin remained stable at 47.6%, while, as expected, operating margin decreased to 28.0% from 29.4% and net income was stable at $1.09 billion.”

- “First nine months net revenues increased 11.1% year-over-year, driven by growth in ADG and MDG Product Groups, partially offset by a decline of AMS Product Group. Operating margin was 27.6% and net income was $3.14 billion.”

- “Our fourth quarter business outlook, at the mid-point, is for net revenues of $4.30 billion, declining year-overyear and sequentially by about 3%; gross margin is expected to be about 46%.”

- “The midpoint of this outlook translates into full year 2023 revenues of about $17.3 billion, representing 7.3% year-over-year growth and a gross margin of about 48.1%.”

Original – STMicroelectronics

-

As expected, the business performance of Siltronic AG in Q3 2023 was marked by weaker demand from the semiconductor industry. Quarterly sales were EUR 349.1 million, 13.5 percent lower than the previous quarter (Q2 2023: EUR 403.7 million).

Despite a noticeable decline in wafer volumes, sales prices continued to be stable. Thanks to this development, the EBITDA margin in the reporting quarter remained at a solid level of 28.4 percent and even reached 29.6 percent after nine months. As the Executive Board expects a slight improvement in Q4 compared to Q3, the annual outlook is confirmed and specified within the communicated range: Group sales for the financial year 2023 are expected to be between 15 and 17 percent below the previous year’s value (exchange rate EUR/USD 1.10), and the EBITDA margin is expected to reach a value between 28 and 30 percent.

Driven by the megatrends artificial intelligence, digitalization, and electromobility, Siltronic is preparing for the next growth phase. The company is well-prepared for this with the expansion of global production capacities in Singapore and investments to improve the product mix in Freiberg.

“Despite the expected decline in wafer demand, Siltronic achieved a solid EBITDA margin of 28.4 percent in Q3. Thanks to the continued stable sales prices for our wafers, we are confident in achieving a respectable EBITDA margin between 28 and 30 percent for the full year. To further support the expected growth in the semiconductor industry in the coming years, we are investing in our new fab in Singapore and are close to producing the first wafers,” commented Dr. Michael Heckmeier, CEO of Siltronic AG, on the development.

Business Development in Q3 2023

Siltronic generated sales of EUR 349.1 million in Q3 2023, down by 13.5 percent compared to the previous quarter (Q2 2023: EUR 403.7 million). After nine months, the company reported sales of EUR 1,157.2 million, down 13.2 percent year-on-year (Q1-Q3 2022: EUR 1,333.2 million). This development was due to the lower wafer area sold. Sales prices remained stable compared to the previous periods and FX changes also had no

significant impact.Cost of sales decreased by 9.7 percent in Q3 2023 compared to the previous quarter and decreased by 2.7 percent in the first nine months of 2023 compared to the period January to September 2022. The decline in sales was more pronounced than the reduction in cost of sales, both quarter-on-quarter and year-on-year. In the quarterly comparison, this is mainly due to increased depreciation.

In a year-on-year comparison, the most important reasons for the disproportionately low reduction in cost of sales are a reduced dilution of fixed costs, higher depreciation and cost increases in labor costs, raw materials and supplies. As a result, the gross profit fell by EUR 25.4 million compared to the previous quarter and by EUR 151.9 million compared to the previous year. The gross margin fell from 33.4 percent to 25.3 percent year-on-year. Q3 includes positive currency effects of EUR 9.9 million (Q2 2023: EUR 6.3 million), which are shown in the balance of other operating income and expenses.

EBITDA in Q3 was EUR 99.1 million and thus EUR 19.5 million below the previous quarter (Q2 2023: EUR 118.6 million). The EBITDA margin remained at a good level of 28.4 percent (Q2 2023: 29.4 percent). After nine months, Siltronic reported EBITDA of EUR 342.8 million (Q1-Q3 2022: EUR 503.5 million – comparable: EUR 453.5 million) and an EBITDA margin of 29.6 percent (Q1-Q3 2022: 37.8 percent – comparable: 34.0 percent). It should be noted that a one-off termination fee of EUR 50.0 million was received in Q1 2022 as a result of the failed tender offer by GlobalWafers.

Due to the lower EBITDA and higher depreciation and amortisation, EBIT amounted to EUR 46.4 million in Q3 (Q2 2023: EUR 70.3 million) and to EUR 194.5 million after the first nine months (Q1-Q3 2022: EUR 370.8 million). Net profit for the quarter was EUR 35.1 million (Q2 2023: EUR 61.4 million) and earnings per share were EUR 1.10 (Q2 2023: EUR 1.83). Net income for the period from January to September was EUR 169.0 million (Q1-Q3 2022: EUR 315.8 million) and earnings per share of EUR 5.13 after EUR 9.46 in the same period of the previous year.

Continued good balance sheet quality as a basis for financing investments

With an equity ratio of 49.3 percent as of September 30, 2023 (December 31, 2022: 51.0 percent), Siltronic continues to have a good balance sheet quality. In the first nine months of the financial year, EUR 51 million more customer prepayments were received than refunded. In addition, the last tranche of a loan to finance our investments was drawn in Q3, as planned.

“Our balance sheet reflects a favourable equilibrium, as about half of our capital is equity. The financing of our new fab in Singapore is based on a broad foundation. This consists of high customer prepayments, which were negotiated within the framework of the long-term agreements concluded. In addition, the financing is based on Siltronic’s sustainable and solid cash flows and the concluded debt financing,” adds Claudia Schmitt, CFO of Siltronic AG.

Cash and cash equivalents and financial investments fell by EUR 542.8 million to EUR 508.1 million in the first nine months of 2023. This was due to payments for capital expenditure including intangible assets of EUR 904.6 million for the construction of the new 300 mm fab in Singapore and the distribution of the dividend to the shareholders of Siltronic AG of EUR 90.0 million.

The cash outflows were offset by cash inflows in the same period of EUR 324.3 million from the cash flow from operating activities. Due to the high investments, the net cash flow, which does not take into account the inflows and outflows from prepayments, was negative at EUR -631.3 million, as expected. This primarily led to Siltronic reporting net financial debt of EUR -315.7 million at the end of September 2023.

Outlook 2023 confirmed and specified: Group sales expected to be 15 to 17 percent below the previous year and EBITDA margin between 28 and 30 percent

In view of the Q3 2023 development, which is in line with expectations, the Executive Board has confirmed the full-year guidance communicated in H1 2023 and confirmed it at the upper end of the range. Even though the end of the weaker demand due to inventory corrections by chip manufacturers and their customers is not expected in Q4 2023, sales in Q4 2023 are expected to be higher than in Q3.

Therefore, Siltronic continues to expect wafer volumes to decline by around 15 percent year-on-year in 2023. Sales prices are expected to remain stable. Accordingly, the full-year guidance has been concretised and group sales are now expected to be 15 to 17 percent (exchange rate EUR/USD: 1.10) below the previous year’s record level of EUR 1,805.0 million. We expect that the increased inventories will also have an impact into the year 2024.

The EBITDA margin in 2023 is also forecast to be significantly lower at 28 to 30 percent, but at the upper end of the range guided in July. In addition to the reduced sales volume, which at the same time leads to a lower dilution of fixed costs, higher costs of less than EUR 40 million due to inflation as well as the aforementioned one-time effect from the previous year contribute to the decline. The stronger euro year-on-year is weighing on the operating result, but Siltronic can expect a positive result from currency hedges in 2023, after a negative contribution in the previous year. The tax rate is expected to be around 15 percent in 2023.

As already communicated in H1 2023, capital expenditure including intangible assets is expected to be at a level of approximately EUR 1.3 billion (2022: EUR 1,074 million). In 2024, Capital expenditure including intangible assets is expected to decrease significantly by more than half. Depreciation is expected to be around EUR 200 million in the financial year.

Megatrends such as artificial intelligence, digitalisation and electromobility form the basis for the expected medium- to long-term growth spurt

Due to the rapidly increasing number of end applications based on megatrends such as artificial intelligence, digitalisation and electromobility, which will lead to a noticeable increase in wafer demand, Siltronic sees great growth potential in the medium and long term. The company is systematically preparing for this by investing heavily in its global production network. The main focus of expenditure is on building up new production capacities in Singapore (FabNext). Siltronic has also invested heavily in improving its product mix. For example, the extension of the crystal pulling hall in Freiberg was successfully inaugurated in September.

Original – Siltronic

-

Renesas Electronics Corporation announced consolidated financial results in accordance with IFRS for the nine months ended September 30, 2023.

Summary of Consolidated Financial Results (Note 1)

Three months ended September 30, 2023 Nine months ended September 30, 2023 Billion Yen % of Revenue Billion Yen % of Revenue Revenue 379.4 100.0 1,107.5 100.0 Operating profit 98.0 25.8 318.5 28.8 Profit attributable to owners of parent 75.3 19.9 271.1 24.5 Capital expenditures

(Note 2)21.3 63.2 Depreciation and amortization 46.9 137.3 R&D expenses (Note 3) 61.2 173.1 Yen Yen Exchange rate (USD) 142 137 Exchange rate (EUR) 156 148 As of September 30, 2023 Billion Yen Total assets 3,291.2 Total equity 2,056.4 Equity attributable to owners of parent 2,052.1 Equity ratio attributable to owners of parent (%) 62.4 Interest-bearing liabilities 710.3 Note 1: All figures are rounded to the nearest 100 million yen.

Note 2: Capital expenditures refer to the amount of capital for property, plant and equipment (manufacturing equipment) and intangible assets based on the amount of investment decisions made during the three months and nine months ended September 30, 2023.

However, the investments from Dialog Semiconductor Limited and Celeno Communications Inc. (hereinafter “Celeno”) are listed as an input basis. It should be noted that as of September 29, 2023, Celeno changed its company name from Celeno Communications Inc. to Renesas Semiconductor Design US Inc.

Note 3: R&D expenses include capitalized R&D expenses recorded as intangible assets.

Note 4: The allocation of the acquisition costs for the business combination with Steradian Semiconductors Private Limited, which was completed on October 17, 2022, has been revised at the end of three months ended March 31, 2023. This revision to the allocation of the acquisition costs has been reflected in the consolidated financial results for the year ended December 31, 2022.

Original – Renesas Electronics