-

LATEST NEWS / PRODUCT & TECHNOLOGY / SiC / WBG2 Min Read

Many industrial applications today are moving towards higher power levels with minimized power losses. One way to achieve this is to increase the DC link voltage. Infineon Technologies AG is addressing this market trend with the CoolSiC™ Schottky diode 2000 V G5 product family, the first discrete silicon carbide diodes with a breakdown voltage of 2000 V, introduced in September 2024.

The product portfolio has now been expanded to include a Schottky diode in the TO-247-2 package, which is pin-compatible with most existing TO-247-2 packages. The product family fits perfectly for applications with DC link voltages up to 1500 V DC, making it ideal for solar and EV chargers.

The CoolSiC Schottky diode 2000 V G5 in the TO-247-2 package is available with current ratings ranging from 10 to 80 A. It allows developers to achieve higher power levels in their applications while reducing the component count by half compared to 1200 V solutions. This simplifies the overall design and facilitates a seamless transition from multi-level to two-level topologies.

In addition, the Schottky diode in the TO-247-2 package incorporates .XT interconnection technology, which significantly reduces thermal resistance and impedance, thereby enhancing heat management. Humidity robustness has been validated through HV-H3TRB reliability testing. The diodes exhibit neither reverse recovery nor forward recovery, and feature a low forward voltage, ensuring improved system performance.

The 2000 V diode family is a perfect match for the CoolSiC MOSFETs 2000 V in the TO-247Plus-4 HCC package that Infineon launched in the spring of 2024. In addition to the TO-247-2 package, the CoolSiC Schottky Diode 2000 V is also available in the TO-247PLUS-4 HCC package.

Original – Infineon Technologies

-

LATEST NEWS / PRODUCT & TECHNOLOGY / SiC / WBG4 Min Read

NoMIS Power has announced a major breakthrough in improving the short-circuit withstand time (SCWT) of SiC MOSFETs. This innovation addresses one of the key challenges limiting the widespread adoption of SiC technology in high-power applications.

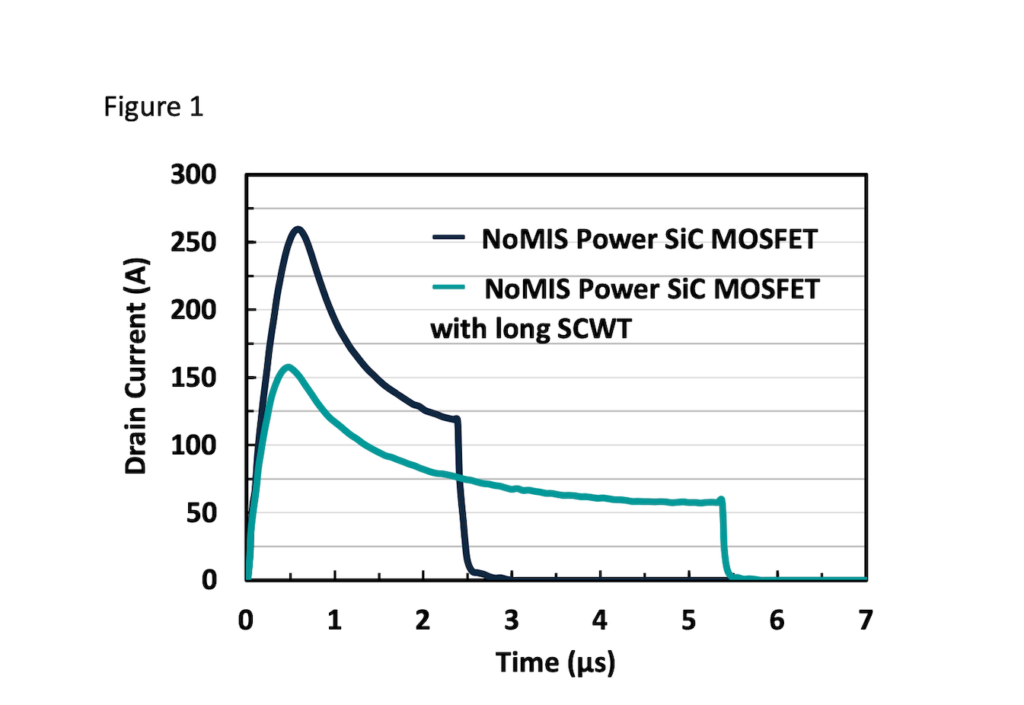

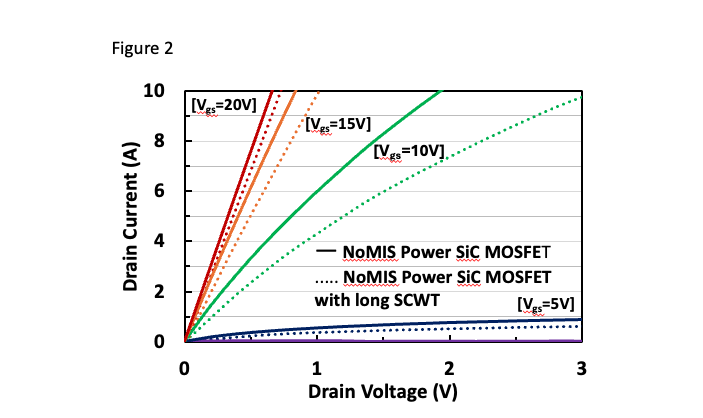

Silicon carbide (SiC) devices have gained prominence in power electronics due to their high efficiency, fast switching, and superior thermal performance. However, their historically lower short-circuit robustness compared to silicon-based IGBTs has posed challenges for their use in high-voltage and high-reliability environments, such as industrial drives, electric vehicles, and grid applications. NoMIS Power’s latest advancement significantly extends the SCWT of SiC MOSFETs to a minimum of 5 µs (Fig. 1), compared to the current industry standard of 2-3 µs, with no deleterious effect on specific on-resistance (Ron,sp) (Fig. 2). This enhancement greatly improves reliability and unlocks new opportunities for system designers seeking to maximize performance while maintaining fault tolerance.

Figure 1: Drain currents of the NoMIS Power SiC MOSFET and NoMIS Power SiC MOSFET with long SCWT under short-circuit conditions right before failure. Drain currents of the 1.2 kV, 80 mΩ SiC MOSFET (dark blue) and the long SCWT 1.2 kV, 80 mΩ SiC MOSFET (light blue) from NoMIS Power are compared. The measurement for short-circuit was conducted under the following conditions: Rg of 20 Ω, Vgs of 20 V, and a Vds of 800 V.

By tuning the trade-off between Ron,sp and SCWT using NoMIS Power’s proprietary SiC MOSFET fabrication design and process flow, the performance shown in Fig. 1 & Fig. 2 was achieved; and can be similarly managed depending on the specific application. Complete optimization of SiC MOSFETs with long SCWT using this approach will allow NoMIS Power to further extend the SCWT while maintaining negligible impact on Ron,sp.

Figure 2: Typical output characteristics of NoMIS Power 1.2 kV, 80 mQ SiC MOSFET and NoMIS Power 1.2 kV, 80 mQ SiC MOSFET with long SCWT showing no significant negative impact on on-resistance.

“At NoMIS Power, we have focused extensively on device architecture engineering, leading to a significant advancement in SiC short-circuit withstand time,” said Woongje Sung, CTO at NoMIS Power. “We believe this achievement provides valuable advantages to the power electronics community, helping engineers integrate SiC solutions with greater confidence in applications where robustness is critical.”

NoMIS Power’s long SCWT devices are well-screened for latent defects and offer easier gate driver desaturation (dSat) design for high di/dt and dv/dt, enabling faster switching frequencies of up to hundreds of kHz. Initial test results demonstrate a 2X to 4X increase in short-circuit withstand time compared to existing SiC devices, positioning NoMIS Power’s technology as a frontrunner in the next generation of power semiconductors. Additionally, when coupled with packaging innovations that impact junction-to-case thermal capacitance, alongside novel thermal management techniques with high heat transfer coefficients, the overall SCWT of the SiC MOSFET can be further improved.

The impact of this innovation extends across multiple industries, including renewable energy, electric transportation, and high-power industrial applications. A longer short-circuit withstand time ensures rugged and reliable performance in critical applications, reinforcing the robustness of SiC-based power systems. For example, built-in redundancy of the SiC MOSFETs inside power converters, which impacts costs as well as power density, can be reduced. Furthermore, applications sensitive to electromagnetic inference, that cannot solely rely on digital control and sensing schemes to detect and act upon short-circuit events, will now be able to effectively utilize SiC MOSFETs with lower risk. As SiC adoption accelerates, NoMIS Power’s breakthrough will play a pivotal role in enhancing the reliability and safety of SiC-based power converters and systems.

NoMIS Power is showcasing this breakthrough technology at APEC 2025, March 16-20, Atlanta, GA, Booth 548 along with its expanded range of SiC discretes and power modules.

Original – NoMIS Power

-

FINANCIAL RESULTS / LATEST NEWS2 Min Read

Magnachip Semiconductor Corporation announced financial results for the fourth quarter and full-year 2024.

Q4 Results Summary

- Consolidated revenue of $63 million was above the mid-point of our guidance range of $59.0 to $64.0 million.

- Standard Product business revenue was down 5.1% sequentially due primarily to seasonality.

- Consolidated gross profit margin of 25.2% was above the high-end our guidance range of 21.5% to 23.5%.

- Standard Product business gross profit margin was 26.6%, up 2.2 percentage points sequentially.

- Repurchased approximately 0.7 million shares for aggregate purchase price of $2.9 million during the quarter and ended Q4 with cash of $138.6 million.

2024 Highlights

- Excluding Transitional Foundry Services, Standard Products business revenue increased 13% year-over-year, with MSS up 22.5% and PAS up 10.2%. Both of these business line growth rates were in line with original guidance for double-digit growth provided at the beginning of 2024.

- PAS revenue growth was strongest in Communication, Computing and Consumer in calendar 2024. Automotive and Industrial declined only slightly, relatively outperforming the broader markets.

- Power IC revenue increased more than 50% year-over-year.

YJ Kim, Magnachip’s CEO, said, “Our Q4 revenue of $63 million was up 24% year-over-year, and gross profit margin of 25.2% was up 2.5 percentage points as compared to a year ago. For the year, Standard Products business revenue increased 13% year-over-year, in line with our guidance for double-digit growth that we provided at the beginning of 2024.”

YJ Kim added, “Our revenue and gross margin results represented a step in the right direction, but our utmost short-term goal is a return to profitability. To achieve this goal, Magnachip announced today its transition to become a pure-play Power company, and we also announced that we are exploring all strategic options for the Display business, which will be classified as discontinued operations when the Company reports Q1 results in May.”

YJ Kim commented, “By focusing on the Power business, Magnachip currently expects to achieve a quarterly Adjusted EBITDA breakeven by the end of Q4 2025 from continuing operations, followed by positive adjusted operating income in 2026, and positive adjusted free cash flow in 2027. Each of these targets will act as milestones towards achieving a goal in 3 years to reach a $300 million annual revenue run-rate with a 30% gross profit margin target. We call this our 3-3-3 strategy.”

Original – Magnachip Semiconductor