-

Navitas Semiconductor announced that Dr. Ranbir Singh, formerly Executive Vice President at Navitas and the founder and CEO of GeneSiC Semiconductor, has been appointed to Navitas’ board of directors.

“We are pleased to welcome Ranbir to the board of directors,” said Gene Sheridan, Chairman, President and CEO. “Ranbir has led the industry with over 30 years of SiC innovation as the founder and CEO of GeneSiC; and 8 years prior to that at Wolfspeed (formerly Cree, Inc.) and brings deep industry knowledge to the board. We look forward to his contributions as we grow our business with next-generation, clean-energy power for an efficient and sustainable future.”

Dr. Singh joined Navitas with the acquisition of GeneSiC Semiconductor, which he founded in 2004. Dr. Singh has dedicated his life to the mission of high-performance, high-reliability silicon carbide technology, and is highly respected in the power electronics community, with several awards, over 200 journal and conference papers, a book and over 40 US patents.

“I am excited to be joining the Navitas board at this pivotal moment as the company leads technical innovation with disruptive, wide band-gap technology, into fast-growing AI, EV and Mobile markets,” said Dr. Singh. “Navitas is executing a significant transformation in the semiconductor industry, and it is an honor to have the opportunity to continue to contribute to the company’s growth and innovation.”

Dr. Singh holds a Bachelor of Technology, Electrical Engineering from the Indian Institute of Technology, Delhi, and both Master’s and PhD in Electrical Engineering – Power Semiconductors, from North Carolina State University (NCSU), Raleigh. He was inducted into NCSU’s Department of Electrical and Computer Engineering (ECE) Alumni Hall of Fame in 2022.

Original – Navitas Semiconductor

-

LATEST NEWS / PRODUCT & TECHNOLOGY / SiC / WBG3 Min Read

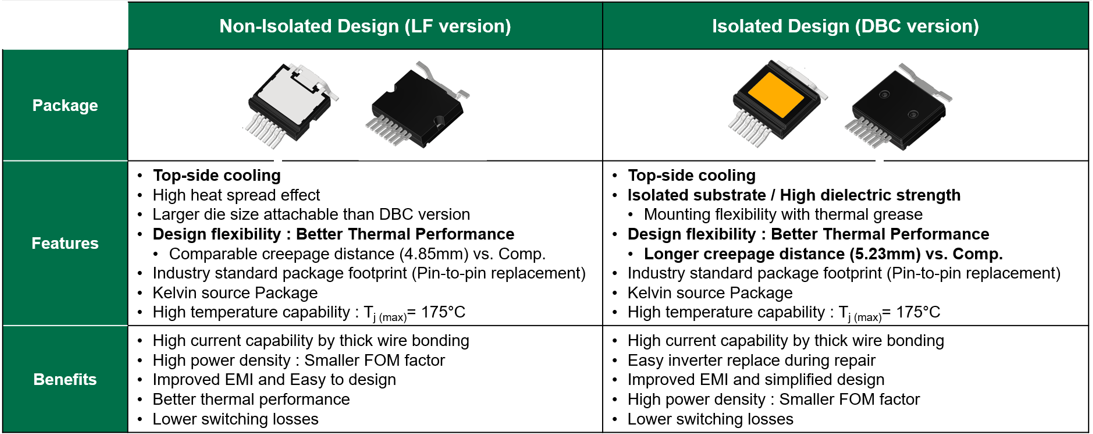

Power Master Semiconductor has announced the expansion of its e SiC MOSFET family with introduction of new AEC-Q101 qualified, high-performance top-side cooling packages. These include the TSPAK DBC version and LF version, specially designed for automotive and industrial applications.

The TSPAK offers superior thermal performance, high efficiency, power density and reliability, making it ideal for a variety of automotive applications such as on-board chargers (OBCs), DC-DC converters, and e-compressors. This innovative packaging leverages Power Master Semiconductor’s latest generation of 1200V eSiC MOSFET (Gen2), employing cutting-edge technology to decouple a trade-off between specific on-resistance (Rsp) and short-circuit withstand time (SCWT). Compared to the previous generation, the new 1200V eSiC MOSFETs deliver 20% reduction in RDS(ON) and a 15% improvement in SCWT, as well as a 45% reduction in switching losses.

Key Features and Benefits of TSPAK

TSPAK LF version

- Top-side cooling package with an exposed drain at the surface, allowing direct heat dissipation to the heatsink.

- Offers superior thermal performance and supports high current capabilities.

- High temperature capability : Tj (max)= 175°C

TSPAK DBC version

- Integrates an isolated DBC ceramic pad on the surface, providing premium thermal performance and enhanced design flexibility.

- Features 3.6kV isolation voltage, extended creepage distance (5.23mm), and flexible mounting by directly connected to an external heatsink with thermal grease.

- High temperature capability : Tj (max)= 175°C

With an industry-standard footprint of 14mm x 18.58mm, the TSPAK packages provide superior thermal performance and Kelvin source configuration to minimizes gate noise and reduces turn-on losses by 60%, enabling higher-frequency operation and improved power density.

The PCR120N40M2A (LF version) and PCRZ120N40M2A (DBC version) are automotive-grade 1200V/40mΩ eSiC MOSFETs in TSPAK packages, leveraging Power Master Semiconductor’s 2nd-generation eSiC MOSFET technology to deliver optimized performance for the automotive systems.

- E-compressors, vital for efficient thermal management, extended battery life, enhanced charging efficiency, and improved driving range.

- Totem-Pole PFC and CLLC/DAB (Dual Active Bridge) topologies, essential for bidirectional power conversion in 800V battery systems used in electric vehicles.

“Cooling is one of the greatest challenges in high power design and successfully addressing it is the key enabler to reducing size and weight, which is critical in modern automotive design” said Namjin Kim, Senior Director of Sales & Marketing. “Our new top-side cooling package offer better system efficiency and minimize heat thermal path on the PCB, the system design will be simplified and compacted. We are confident that this innovative solution will be the optimal choice for high-performance automotive applications.”

“Efficient cooling is a critical challenge for reducing size and weight of high-power automotive systems,” said Namjin Kim, Senior Director of Sales & Marketing. “Our new top-side cooling package enhances system efficiency and minimizes the thermal path on the PCB, enabling simpler, more compact system designs. We believe this innovative solution will drive the high performance automotive applications.”

Original – Power Master Semiconductor

-

Infineon Technologies AG has won the German Sustainability Award in the “Electrical Engineering and Electronics” category. “The jury is of the opinion that Infineon has assumed a leading role in the field of sustainability and serves the sector as a ‘beacon’ for successful transformation,” the judges said in their statement. The German Sustainability Award recognizes companies which make effective and exemplary contributions to transformation and which function as role models within their industry.

“We are particularly honored and delighted to win the German Sustainability Award,” said Elke Reichart, Member of the Management Board and Chief Digital and Sustainability Officer at Infineon, who accepted the award in Duesseldorf. “We at Infineon work hard to drive decarbonization and digitalization and to create a more sustainable future. This award is recognition, as well as an incentive to be a role model in sustainability and to continue rigorously implementing our ambitious sustainability strategy – together with our employees, customers and partners.”

Infineon is pursuing a comprehensive and ambitious decarbonization strategy. The company is making good progress towards the goal it defined in 2020: achieving climate neutrality by 2030. Since then, emissions have been reduced by more than two thirds while revenue has almost doubled. Moreover, Infineon is intensifying its collaboration along the entire supply chain. As a pioneer in its industry, Infineon this year began reporting emissions at the individual product level, referred to as the Product Carbon Footprint. The data is already available for half of all Infineon products today.

Infineon’s semiconductors are decisive in making the generation, transmission, storage and use of energy more efficient. A recent example of sustainable product innovation by Infineon is a new type of energy-saving silicon carbide (SiC) module, whose developers were nominated for the 2024 Deutscher Zukunftspreis. The solution increases the energy efficiency of existing high-performance electrical applications such as solar and wind power plants and train drives. Among other things, the module also facilitates the efficient electrification of large drives such as those found in agricultural and construction machinery, ships and aircraft. In concrete terms, a single electric locomotive equipped with the new drive system saves around 300 megawatt hours per year, which corresponds to the annual energy requirements of 100 single-family homes.

The German Sustainability Award is Europe’s largest award for ecological and social commitment. The jury of the German Sustainability Award (DNP) selected winners in 100 different sectors from among around 2000 competing companies. The German Sustainability Award works together with the German Chamber of Industry and Commerce (DIHK), WWF Germany, PwC Germany, Leuphana University Lüneburg (CSM Lüneburg) and numerous other industry associations to design and implement the competition.

Current reports on sustainability at Infineon can be found here.

Original – Infineon Technologies

-

Analog Devices, Inc. announced financial results for its fiscal fourth quarter and fiscal year 2024, which ended November 2, 2024.

“ADI’s revenue, profitability, and earnings per share all finished above our guided midpoint, underscoring continued business momentum and solid execution,” said Vincent Roche, CEO and Chair. “While unprecedented customer inventory headwinds drove a historic revenue decline during fiscal 2024, we maintained operating margins north of 40%, which is a testament to our business model’s resilience. We also continued to make strategic, long-term investments across engineering, manufacturing, and the end-to-end customer experience. As such, we enter 2025 as an even stronger enterprise, giving me the utmost confidence in our ability to drive increased value for customers and shareholders over the long term.”

“After a brief decline in overall bookings during our third quarter, orders picked up steadily throughout the fourth quarter, particularly in the Automotive end market. While macro uncertainty continues to limit the pace of our recovery, we remain cautiously optimistic for a strong growth year in fiscal 2025,” said Richard Puccio, CFO.

Performance for the Fourth Quarter and Fiscal Year 2024 (PDF)

Outlook for the First Quarter of Fiscal Year 2025

For the first quarter of fiscal 2025, we are forecasting revenue of $2.35 billion, +/- $100 million. At the midpoint of this revenue outlook, we expect reported operating margin of approximately 22.0%, +/- 130 bps, and adjusted operating margin of approximately 40.0%, +/- 100 bps. We are planning for reported EPS to be $0.80, +/- $0.10, and adjusted EPS to be $1.53, +/- $0.10.

Our first quarter fiscal 2025 outlook is based on current expectations and actual results may differ materially as a result of, among other things, the important factors discussed at the end of this release. These statements supersede all prior statements regarding our business outlook set forth in prior ADI news releases, and ADI disclaims any obligation to update these forward-looking statements.

The adjusted results and adjusted anticipated results above are financial measures presented on a non-GAAP basis. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures are provided in the financial tables included in this release. See also the “Non-GAAP Financial Information” section for additional information.

Original – Analog Devices

-

LATEST NEWS2 Min Read

Wolfspeed announced that Melissa Garrett has been appointed Senior Vice President and General Counsel, effective December 9, 2024. Garrett succeeds Brad Kohn, who has resigned from the company for another professional opportunity.

Garrett brings extensive legal expertise and has served as a senior member of Wolfspeed’s legal team leading global employment and non-patent litigation matters since 2015. She brings a comprehensive legal background in contracts and negotiations, litigation management, corporate governance, employment law, policy and mergers and acquisitions.

“Melissa’s contributions to Wolfspeed over the last nine years have been highly valuable, and we are pleased to welcome her to the role of General Counsel,” said Tom Werner, Executive Chairman. “With her proven track record in legal, risk and compliance, coupled with her deep institutional knowledge of Wolfspeed, she is uniquely qualified to step into this role. We deeply appreciate Brad’s tireless advocacy for Wolfspeed over the years and thank him for his dedication and many contributions to the company. He and Melissa have been working closely on all key projects, so we expect a smooth transition and we wish him all the best in his future endeavors.”

Prior to joining Wolfspeed, Garrett served as Deputy General Counsel and Assistant Corporate Secretary at Kangaroo Express. She previously served as an attorney at Jackson Lewis and Paul, Hastings, Janofsky & Walker LLP, and began her career as an attorney at Fisher & Philips. She holds a Juris Doctor from Indiana University and a Bachelor of Arts from University of Wisconsin-Madison.

Original – Wolfspeed

-

LATEST NEWS1 Min Read

Navitas Semiconductor announced that the company’s revenue growth has been acknowledged for the third consecutive year, by Deloitte’s Technology Fast 500™. Navitas growth was driven by strong demand for its advanced, high-efficiency, wide-bandgap gallium nitride (GaN) and silicon carbide (SiC) power components, across a growing number of global markets and customers.

Now in its 30th year, the Deloitte Technology Fast 500 provides a ranking of the fastest-growing technology, media, telecommunications, life sciences, fintech, and energy tech companies — both public and private — in North America. Based on percentage fiscal year revenue growth from 2020 to 2023, Navitas achieved 571% growth as GaN and SiC technology enabled efficient, sustainable applications and displaced legacy silicon chips.

“As a ‘pure-play’, next-gen, semiconductor company, Navitas continues to outperform the overall power semiconductor market, with record sales into mobile fast chargers, now ramping AI data center revenues and a strong customer pipeline for EV opportunities,” said Gene Sheridan, CEO and co-founder. “Recent introductions like GaNSafe™, Gen-3 ‘Fast’ SiC, and a newly-announced, 48V-focused range in partnership with Infineon, have built a strong foundation for further revenue growth in applications from 20W to 20MW, and with a market opportunity of over $22B per year.”

Original – Navitas Semiconductor