-

NXP Semiconductors N.V. reported financial results for the third quarter, which ended September 29, 2024.

“NXP delivered quarterly revenue of $3.25 billion, in-line with our overall guidance. While we experienced some strength against our expectations in the Communication Infrastructure, Mobile and Automotive end markets, we were confronted with increasing macro related weakness in the Industrial & IoT market. Our guidance for the fourth quarter reflects broader macro weakness especially in Europe and the Americas. We focus on managing what is in our control enabling NXP to drive resilient profitability and earnings in an uncertain demand environment,” said Kurt Sievers, NXP President and Chief Executive Officer.

Key Highlights for the Third Quarter 2024:

- Revenue was $3.25 billion, down 5 percent year-on-year;

- GAAP gross margin was 57.4 percent, GAAP operating margin was 30.5 percent and GAAP diluted Net Income per Share was $2.79;

- Non-GAAP gross margin was 58.2 percent, non-GAAP operating margin was 35.5 percent, and non-GAAP diluted Net Income per Share was $3.45;

- Cash flow from operations was $779 million, with net capex investments of $186 million, resulting in non-GAAP free cash flow of $593 million;

- During the third quarter of 2024, NXP continued to execute its capital return policy with the payment of $259 million in cash dividends, and the repurchase of $305 million of its common shares. The total capital return of $564 million in the quarter represented 95 percent of third quarter non-GAAP free cash flow. On a trailing twelve month basis, capital return to shareholders represented $2.4 billion or 87 percent of non-GAAP free cash flow. The interim dividend for the third quarter 2024 was paid in cash on October 9, 2024 to shareholders of record as of September 12, 2024. On August 29th, the NXP board of directors authorized an additional $2.0 billion for share repurchases, resulting in a $2.64 billion share repurchase balance at the end of the third quarter. Subsequent to the end of the third quarter, between September 30, 2024 and November 1, 2024, NXP executed via a 10b5-1 program additional share repurchases totaling $117 million;

- On August 20, 2024, ESMC, the previously announced manufacturing joint venture between TSMC, Robert Bosch GmbH, Infineon Technologies AG and NXP Semiconductors N.V. held a groundbreaking ceremony to mark the initial phase of construction of its first semiconductor fab in Dresden, Germany;

- On September 4, 2024, Vanguard International Semiconductor Corporation and NXP Semiconductors N.V. announced the receipt of all necessary governmental approvals from relevant authorities and injected capital to officially establish the previously announced VisionPower Semiconductor Manufacturing Company Pte Ltd (VSMC) manufacturing joint venture. The company will now proceed with the planned construction of VSMC’s first 300mm wafer manufacturing facility;

- On September 10, 2024, NXP announced the Trimension® SR250, the industry’s first single-chip, UWB solution to enable Industrial and IoT applications that integrates on-chip processing capabilities with both short-range UWB-based radar and secure ranging;

- On September 17, 2024, NXP announced the MC33777, the world’s first electric vehicle battery junction box IC that consolidates essential BMS functions into a single device; and

- On September 24, 2024, NXP announced the new i.MX RT700 crossover MCU family, designed to power smart AI-enabled edge devices, such as wearables, consumer medical devices, smart home devices and HMI platforms.

Original – NXP Semiconductors

-

GaN / LATEST NEWS / WBG3 Min Read

Cambridge GaN Devices (CGD) will exhibit at Electronica which runs from November 12-15, 2024 at the Messe München, Munich, Germany. This will be the second time that the company has exhibited at the world’s leading trade fair and conference for electronics, marking the company’s position as a leader in delivering gallium-nitride power ICs which are easy to use and very reliable.

ANDREA BRICCONI | CHIEF MARKETING OFFICER, CGD

“Since our first appearance at Electronica, CGD has made remarkable steps. We have introduced our P2 series ICeGaN® ICs that feature RDS(on) levels down to 25 mΩ, supporting multi kW power levels with the highest efficiency. We have announced a deal with TSMC, the leading IC fabrication house in the world which ensures quality and supply of our innovative power devices. Also, studies by leading academic research establishment, Virginia Tech University, have demonstrated that our ICeGaN GaN technology is more reliable and robust than other GaN platforms. GaN is now available for use at higher power levels, and at Electronica we are expecting to meet with designers who are eager to take advantage of the efficiency and power density benefits that GaN can bring to their latest designs.”During the show, CGD will make two presentations:

- November 12, 13:20 – 14:10, Booth A5.351: SiC & GaN Technologies – Exploring Advancements, Addressing Challenges CGD’s CTO and co-founder, Professor Florin Udrea will join a panel of GaN experts for a Panel Discussion moderated by Maurizio Di Paolo Emilio, Editor-in-Chief, Power Electronics News.

- November 12, 16:10-16:35, Power Electronics Forum: ICeGaN as a smart high voltage platform for high power industrial and automotive applications presented by Professor Florin Udrea.

The power devices field has undergone significant change due to the emergence of Wide Band Gap semiconductors, particularly Gallium Nitride (GaN) and Silicon Carbide (SiC). Traditionally, GaN has been used for lower power consumer applications (e.g., power supplies), while SiC dominated the medium to high power markets, such as industrial (e.g., motor drives) and automotive applications (e.g., traction inverters).

SiC’s superior scaling of on-state resistance at high voltages gives it an edge above 1.2 kV, but GaN is now competing with SiC at 650V for all power levels. ICeGaN®, featuring sensing and protection functions, surpasses discrete SiC in terms of robustness and ease of paralleling, offering notable advantages for 650V high-power applications. Additionally, with the rise of multi-level topologies for traction inverters, GaN may challenge SiC’s 1.2 kV market. Ultimately, both technologies have a bright future, with overlap expected in high-power (10-500 kW) applications.

At Electronica, CGD will show a number of demos that employ ICeGaN, including:

- 3 kW totem-pole PFC evaluation board;

- High and low power QORVO motor drive evaluation kits developed in collaboration with CGD and utilising ICeGaN

- Half-bridge and full-bridge evaluation boards, plus an ICeGaN in parallel evaluation board;

- Single leg of a 3-phase 800 V automotive inverter demo board, developed in partnership with French public R&I institute, IFP Energies nouvelles (IFPEN);

- ICeGaN vs discrete GaN circuits comparison in half bridge (daughter cards) demo board.

- High-density USB-PD adaptor developed with Industrial Technology Research Institute (ITRI) of Taiwan

Original – Cambridge GaN Devices

-

GaN / LATEST NEWS / PRODUCT & TECHNOLOGY / WBG2 Min Read

Infineon Technologies AG announced the launch of a new family of high-voltage discretes, the CoolGaN™ Transistors 650 V G5, further strengthening its Gallium Nitride (GaN) portfolio. Target applications for this new product family range from consumer and industrial switched-mode power supply (SMPS) such as USB-C adapters and chargers, lighting, TV, data center and telecom rectifiers to renewable energy and motor drives in home appliances.

The latest CoolGaN generation is designed as a drop-in replacement for the CoolGaN Transistors 600 V G1, enabling rapid redesign of existing platforms. The new devices provide improved figures of merit to ensure competitive switching performance in focus applications.

Compared to key competitors and previous product families from Infineon, the CoolGaN Transistors 650 V G5 offer up to 50 percent lower energy stored in the output capacitance (E oss), up to 60 percent improved drain-source charge (Q oss) and up to 60 percent lower gate charge (Q g). Combined, these features result in excellent efficiencies in both hard- and soft-switching applications. This leads to a significant reduction in power loss compared to traditional silicon technology, ranging from 20 to 60 percent depending on the specific use case.

These benefits allow the devices to operate at high frequencies with minimal power loss, resulting in superior power density. The CoolGaN Transitors 650 V G5 enable SMPS applications to be smaller and lighter or to increase the output power range in a given form factor.

The new high-voltage transistor product family offers a wide range of R DS(on) package combinations. Ten R DS(on) classes are available in various SMD packages, such as ThinPAK 5×6, DFN 8×8 , TOLL and TOLT. All products are manufactured on high-performance 8-inch production lines in Villach (Austria) and Kulim (Malaysia). In the future, CoolGaN will transition to 12-inch production. This will enable Infineon to further expand its CoolGaN capacity and ensure a robust supply chain in the GaN power market, which is expected to reach $2 billion by 2029, according to Yole Group.

A demo featuring the CoolGaN Transistors 650 V G5 will be showcased at electronica 2024 in Munich from November 12 to 15 (hall C3, booth 502).

Original – Infineon Technologies

-

GaN / LATEST NEWS / PRODUCT & TECHNOLOGY / WBG2 Min Read

Power Integrations introduced a new member of its InnoMux™-2 family of single-stage, independently regulated multi-output offline power supply ICs. The new device features the industry’s first 1700 V gallium nitride switch, fabricated using the company’s proprietary PowiGaN™ technology.

The 1700 V rating further advances the state-of-the-art for GaN power devices, previously set by Power Integrations’ own 900 V and 1250 V devices, both launched in 2023. The 1700 V InnoMux-2 IC easily supports 1000 VDC nominal input voltage in a flyback configuration and achieves over 90 percent efficiency in applications requiring one, two or three supply voltages.

Each output is regulated within one percent accuracy, eliminating post regulators and further improving system efficiency by approximately ten percent. The new device replaces expensive silicon carbide (SiC) transistors in power supply applications such as automotive chargers, solar inverters, three-phase meters and a wide variety of industrial power systems.

Radu Barsan, vice president of technology at Power Integrations, said, “Our rapid pace of GaN development has delivered three world-first voltage ratings in a span of less than two years: 900 V, 1250 V and now 1700 V. Our new InnoMux-2 ICs combine 1700 V GaN and three other recent innovations: independent, accurate, multi-output regulation; FluxLink™, our secondary-side regulation (SSR) digital isolation communications technology; and zero voltage switching (ZVS) without an active-clamp, which all but eliminates switching losses.”

Original – Power Integrations

-

FINANCIAL RESULTS / LATEST NEWS2 Min Read

Magnachip Semiconductor Corporation announced financial results for the third quarter 2024.

YJ Kim, Magnachip’s CEO, commented, “Our Q3 revenue was at the high-end of guidance driven by broad-based growth in our Standard Product businesses, which is comprised of our MSS and PAS businesses. Standard Product revenue increased 25.9% sequentially and 24% year-over-year. Our discrete Power business benefited from leaner inventory in distribution channels as well as new product designs wins resulting in better-than-seasonal growth. In MSS, the strong sequential growth was due to increased demand for products targeted for China smartphone OEMs, automotive displays, and OLED IT.”

YJ Kim added, “Looking ahead, we expect our Standard Product business revenue in Q4 will modestly decline sequentially, which is better than typical seasonality experienced in past years. We reiterate our full-year guidance for double-digit growth in both MSS and PAS businesses in 2024.”

Financial Highlights

- Q3 consolidated revenue was $66.5 million, at the high-end of guidance range of $61.5-66.5 million.

- Q3 standard product business revenue was up 25.9% sequentially.

- Q3 consolidated gross profit margin of 23.3% was in-line with the mid-point of guidance range of 22.5-24.5%.

- Q3 standard product business gross profit margin was 24.4%, up 1.3 percentage points sequentially.

- Ended Q3 with cash of $121.1 million; and an additional non-redeemable short-term financial investment of $30 million.

- Repurchased approximately 0.5 million shares for aggregate purchase price of $2.5 million during the quarter.

Operational Highlights

- Broad-based sequential revenue growth in our PAS business was driven by leaner distribution channels and better-than-typical seasonality. Relative strength was more evident in industrial, computing, and consumer applications. Automotive continues to show strength with additional design wins in Japan and China.

- Started initial DDIC production and shipments for a premium smartphone model from a leading China OEM.

- Received a purchase order from a second leading China smartphone OEM and commenced shipments in October 2024.

- Began sampling our new OLED driver designed with next-generation IP, including sub-pixel rendering (SPR), refined color enhancement, color filter, brightness uniformity control and more than 20% reduction in power consumption than previous generation.

- Power IC revenue increased sequentially, driven primarily by demand for LCD TVs and OLED IT in tablets and notebooks.

Original – Magnachip Semiconductor

- Q3 consolidated revenue was $66.5 million, at the high-end of guidance range of $61.5-66.5 million.

-

STMicroelectronics N.V. (“ST”) reported U.S. GAAP financial results for the third quarter ended September 28, 2024. ST reported third quarter net revenues of $3.25 billion, gross margin of 37.8%, operating margin of 11.7%, and net income of $351 million or $0.37 diluted earnings per share. Jean-Marc Chery, ST President & CEO, commented:

- “Q3 net revenues were in line with the midpoint of our business outlook range. Our revenues, compared to our expectations, were higher in Personal Electronics, declined less in Industrial and were lower in Automotive. Q3 gross margin of 37.8% was broadly in line with the mid-point of our business outlook range.”

- “First nine months net revenues decreased 23.5% year-over-year across all reportable segments, particularly in Microcontrollers, which is impacted by a continuing weakness in the Industrial market. Operating margin was 13.1% and net income was $1.22 billion.”

- “Our fourth quarter business outlook, at the mid-point, is for net revenues of $3.32 billion, decreasing yearover-year by 22.4% and increasing sequentially by 2.2%; gross margin is expected to be about 38%, impacted by about 400 basis points of unused capacity charges.”

- “The midpoint of this outlook translates into full year 2024 revenues of about $13.27 billion, representing a 23.2% year-over-year decrease, in the low-end of the range indicated in the previous quarter, and a gross margin slightly below that provided in such indication.”

- “Based on our current customer order backlog and demand visibility, we anticipate a revenue decline between Q4 2024 and Q1 2025 well above normal seasonality.”

- “We are launching a new company-wide program to reshape our manufacturing footprint accelerating our wafer fab capacity to 300mm Silicon (Agrate and Crolles) and 200mm Silicon Carbide (Catania) and resizing our global cost base. This program should result in strengthening our capability to grow our revenues with an improved operating efficiency resulting in annual cost savings in the high triple-digit million-dollar range exiting 2027.”

Original – STMicroelectronics

-

Renesas Electronics Corporation announced consolidated financial results in accordance with IFRS for the nine months ended September 30, 2024.

Summary of Consolidated Financial Results (Note 1)

Summary of Consolidated Financial Results (Non-GAAP basis) (Note 2)

Three months ended September 30, 2024 Nine months ended September 30, 2024 Billion Yen % of Revenue Billion Yen % of Revenue Revenue 345.3 100.0 1,055.9 100.0 Gross profit 192.8 55.9 595.7 56.4 Operating profit 98.4 28.5 322.5 30.5 Profit attributable to owners of parent 86.0 24.9 288.5 27.3 EBITDA (Note 3) 121.4 35.2 388.0 36.7 Summary of Consolidated Financial Results (IFRS basis)

Three months ended September 30, 2024 Nine months ended September 30, 2024 Billion yen % of Revenue Billion yen % of Revenue Revenue 345.3 100.0 1,055.9 100.0 Gross profit 192.2 55.7 590.6 55.9 Operating profit 57.2 16.6 204.8 19.4 Profit attributable to owners of parent 60.6 17.6 200.3 19.0 EBITDA (Note 3) 109.0 31.6 355.3 33.7 Reconciliation of Non-GAAP gross profit to IFRS gross profit and Non-GAAP operating profit to IFRS operating profit

(Billion yen)

Three months ended September 30, 2024 Nine months ended September 30, 2024 Non-GAAP gross profit

Non-GAAP gross margin192.8

55.9%595.7

56.4%Amortization of purchased intangible assets and depreciation of property, plant and equipment (0.2) (0.8) Stock-based compensation (0.8) (2.1) Other reconciliation items in non-recurring

expenses and adjustments (Note 4)0.4 (2.4) IFRS gross profit

IFRS gross margin192.2

55.7%590.6

55.9%Non-GAAP operating profit

Non-GAAP operating margin98.4

28.5%322.5

30.5%Amortization of purchased intangible assets and depreciation of property, plant and equipment (28.7) (85.0) Stock-based compensation (10.0) (24.9) Other reconciliation items in non-recurring expenses and adjustments (Note 4) (2.4) (7.8) IFRS operating profit

IFRS operating margin57.2

16.6%204.8

19.4%Note 1: All figures are rounded to the nearest 100 million yen.

Note 2: Non-GAAP figures are calculated by removing or adjusting non-recurring items and other adjustments from GAAP (IFRS) figures following a certain set of rules. The Group believes non-GAAP measures provide useful information in understanding and evaluating the Group’s constant business results.

Note 3: Operating profit + Depreciation and amortization.

Note 4: “Other reconciliation items in non-recurring expenses and adjustments” includes the non-recurring items related to acquisitions and other adjustments as well as non-recurring profits or losses the Group believes to be applicable.

Original – Renesas Electronics

-

FINANCIAL RESULTS / LATEST NEWS1 Min Read

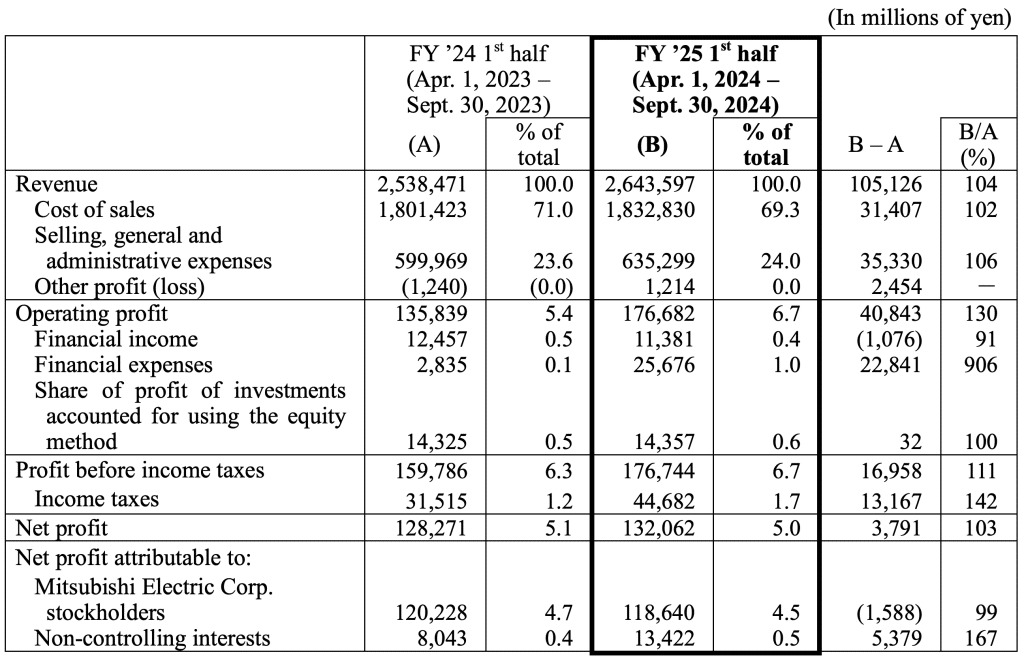

Mitsubishi Electric Corporation announced its consolidated financial results for the second quarter (first half), ended September 30, 2024, of the current fiscal year ending March 31, 2025 (fiscal 2025).

Original – Mitsubishi Electric

-

Ideal Power Inc. announced that the Company received orders from a global Tier 1 automotive supplier, a NYSE listed company. This global customer serves many automotive OEMs and is a leading supplier of sensors and electrical protection component solutions for automobile electrification and electric vehicles (EVs). They represent the latest addition to the Company’s customer list of Tier 1 suppliers targeting the EV market.

The Company is meeting regularly with this Tier 1 auto supplier and educating them on the benefits of B-TRAN™ in EV applications. As a result of these ongoing discussions, the customer placed orders for numerous discrete B-TRAN™ devices, a SymCool® power module, a solid-state circuit breaker evaluation board and a driver. This customer is interested in using B-TRAN™ for solid-state EV contactor applications.

“We are pleased to see another global Tier 1 automotive supplier securing B-TRAN™ products as part of their desire to bring lower cost, more efficient semiconductor solutions to their numerous automotive OEM customers. We are also working to advance other Tier 1 auto suppliers in our sales pipeline to orders and then to custom development agreements and/or design wins,” stated Dan Brdar, President and Chief Executive Officer of Ideal Power. “Overall, we are leveraging our success with Stellantis to attract and engage other auto OEMs as well as the Tier 1 auto suppliers that provide sub-systems to these global automakers.”

Contactors serve as cutoff switches for high voltage applications in EVs. They play a critical role in isolating the battery, inverter, and onboard charger to ensure safety when the vehicle is off or being serviced. In a collision, power must be shut off from downstream systems to prevent further complications or damage. Contactors are bidirectional and there are typically 4 to 6 high-power contactors in every EV. The high-power EV contactor market is forecasted to grow to over $3.7 billion in 2025 and the Company believes that, over time, solid-state contactors will potentially displace electromechanical contactors in half or more of this market.

Solid-state contactors provide several benefits over electromechanical contactors. They act much faster, thereby eliminating arcing and improving safety, and are more reliable as they do not include physical contacts subject to wear. In addition, they provide programmable settings for trip and current limits as well as built-in safety diagnostics. Solid-state contactors are also expected to cost less than electromechanical contactors in EV applications.

Original – Ideal Power

-

GaN / LATEST NEWS / SiC / WBG3 Min Read

Navitas Semiconductor will showcase its latest innovations at the 2024 China Power Electronics and Energy Conversion Conference and the 27th Annual Academic Conference and Exhibition of the China Power Supply Society (CPEEC & CPSSC 2024), held in Xi’an from November 8th – 11th, 2024.

At ‘Planet Navitas’ (Booth 3-011), visitors can discover the AI Power Roadmap, which showcases the world’s first 8.5 kW OCP AI data center power supply implementing GaNSafe and Gen-3 Fast SiC MOSFETs, alongside the highest power density 4.5 kW AI data center power supply on the planet. Navitas also developed the ‘IntelliWeave’ patented digital control combined with high-power GaNSafe™ and Gen 3-Fast SiC MOSFETs, optimized for AI data center power supplies, enabling PFC peak efficiencies to 99.3% and reducing power losses by 30% compared to existing solutions.

Additionally, industry-leading solutions include a 6.6kW 2-in-1 EV on-board charger (OBC) utilizing a hybrid GaNSafe and GeneSiC design and fast-charging solutions for consumer electronics with the latest GaNSlim family.

The new GaNSlim family offers a highly integrated GaN solution with autonomous EMI control and loss-less sensing that enables the industry’s fastest, smallest, and most efficient solution in an optimized DPAK-4L package, ideal for mobile, consumer, and home appliance applications up to 500 W.

Enabled by over 20 years of SiC innovation leadership, GeneSiC technology leads on performance with the Gen-3 Fast SiC MOSFETs with ‘trench-assisted planar’ technology. This proprietary technology provides world-leading performance over temperature, delivering cool-running, fast-switching, and superior robustness to support up to 3x more powerful AI data centers and faster charging EVs.

As China’s premier power electronics event, CPSSC gathers industry leaders, researchers, and enterprises to explore breakthrough technologies shaping the future of power electronics. This year’s focus is on high-efficiency, high-power density solutions. “CPSSC is a key platform to showcase Navitas’ role in advancing power electronics,” said Charles Zha, VP & GM of Navitas China. “Our GaNSafe, GaNSlim, and Gen-3 Fast SiC technologies highlight our commitment to enabling higher efficiency, faster charging, and more powerful applications, aligning with CPSSC’s vision of powering the future.”

Navitas will also present technical papers and host industrial sessions, sharing insights into GaN and SiC technologies and their real-world applications.

Navitas’ CPSSC 2024 Program Highlights:

- November 10

- Paper Presentation:

Research on Parasitic False Turn-On Behaviour of SiC MOSFETs with 0V Turn-Off Gate Voltage

13:20-13:40 | Xiangyang Zhou, Bin Li, Xiucheng Huang, Jason Zhang - Industrial Session:

Bi-Directional GaN for Improving Efficiency in Micro-Inverters

14:30-15:00 | Simon Qin, Sr. Staff Application Engineer

- November 11

- Technical Presentation:

Achieving 99.4% Efficiency in GaN-based Interleaving CrM TTP PFC

08:30-09:00 | Wenhao Yu, Sr. Application Engineer - Technology Showcase:

GaNSlim IC: Redefining Efficiency in Cost-Effective Power Supplies

10:20-10:50 | Ye Hu, Technical Marketing Manager - Industry Insights:

Opportunities and Challenges of Single-Stage Converters for On-Board Chargers

13:00-13:30 | Justin Zhu, Sr. Technical Marketing Manager

Original – Navitas Semiconductor