-

Vincotech is returning to PCIM, the world’s leading power electronics expo and conference to showcase its latest technologies and innovations, including GaN and many more products for Motion Control, Renewable and Power Supply use cases. In keeping with this year’s expo slogan “Empowering your ideas,” the company’s application-specific capabilities will be on prominent display.

Highly anticipated, PCIM Europe event is sure to draw thousands of visitors, and Vincotech is thrilled to be back. “Our fair booth will feature all kinds of new tech, and we can’t wait to show customers and prospects how our solutions benefit their business. Hot topics, innovations, donations – expect all that and more”, says Edoardo Guiotto, VP Sales and Marketing.

This year’s big talking point is the company’s commitment to application-specific solutions enabled by a wide range of industrystandard and proprietary housings, multi-source chipsets, expedited time-to-market, and early sample availability. Highlights include a solution for SEW-EURODRIVE, showcased with a station displayed at the booth.

- One spotlight will be on GaN, a cutting-edge technology that has the industry abuzz. Vincotech, which is driving advances on this front, is going to demonstrate the potential, benefits, and applications of GaN in power modules.

- Innovations in motor control applications will also figure prominently. Reliability and performance packed into a small footprint – that’s what sophisticated motor control use cases need. Highly integrated and engineered to support complex electrical and thermal designs, Vincotech’s embedded drive solutions meet these demands. For Industrial drives the tandem diode solutions are available for SixPack, Twin SixPack and PIM topologies including custom and industry standard power module housings.

- Renewables are on the rise. Built on decades of experience in solar, Vincotech’s extensive portfolio of PV & ESS solutions is second to none. Residential, industrial, commercial – every use case and power range is well-covered.

- Leading the way in power supply, Vincotech offers outstanding power module solutions. Highlights in DC fast charging include a built-to-boost 3-phase resonant converter, the fastPACK 1 GaN 2-in-1 featuring advanced Wide Bandgap (WBG) tech, and many ultra-compact, integrated solutions and low inductive modules. Enhancing the performance of Uninterruptible Power Supplies (UPS), Vincotech has a wide range of solutions from 20 kW – 250 kW power.

Like in previous years, Vincotech teams up with Plan International Germany, bringing an exciting VR experience to the event. Visitors can challenge themselves by flying over the mountains in virtual reality, while knowing their participation supports a greater good. Vincotech will match all flights with a donation, targeting a Plan International project for teenagers in Ecuador.

Vincotech’s PCIM presentations at a glance:

Tuesday, June 11

11:15 Exhibitor forum

David Chilachava: NEW fastPACK 1 GaN – The Best Utilization of GaN Technology Benefits in an Industrial Power Module PackageWednesday, June 12

11:20 Bodo’s panel discussion on “SiC Wide Bandgap Design, the Future of Power”)

Evangelos Theodossiu: SiC power module design: Why does it matter?

14:30 Conference, Room: München 2

A joint presentation with Siemens: Optimizing a Power Module for Electrical and Thermal Performance and Symmetry Using EDA ToolsThursday June 13

11:15 Conference poster sessions

Tiago Jappe: Power Module Solutions with Improved Reliability for Elevator Drive Applications

14:35 Exhibitor forum

Matthias Tauer: flow E3 Full SiC Power Module with Direct Pressed Substrate for Superior Thermal Performance and ReliabilityOriginal – Vincotech

-

GaN / LATEST NEWS / PRODUCT & TECHNOLOGY / WBG3 Min Read

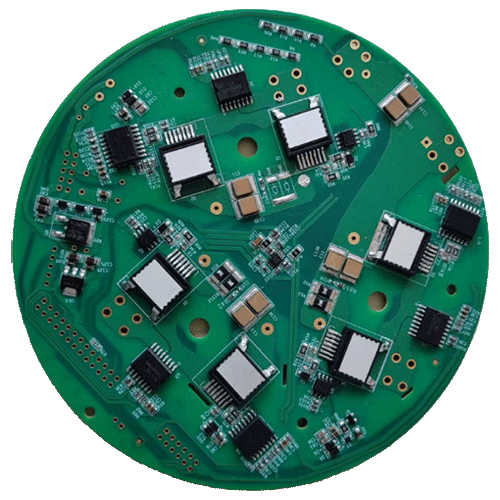

Cambridge GaN Devices is partnering with Qorvo® to develop a reference design and evaluation kit (EVK) that showcases GaN for motor control applications. CGD aims to speed the use of GaN power ICs in BLDC and PMSM applications, resulting in higher power, highly efficient, compact and reliable systems. Qorvo is building an EVK for its PAC5556A motor/control IC that is powered by CGD’s ICeGaN™ (IC-enhanced GaN) technology.

GIORGIA LONGOBARDI | CEO, CGD

“Because ICeGaN – unlike other GaN implementations from other companies – integrates the interface circuitry but not the controller together with the GaN HEMT, it is simple to combine with highly integrated motor controller and drive ICs such as Qorvo’s PAC5556A 600 V High Performance BLDC / PMSM Motor Controller and Driver. We are delighted to partner with Qorvo to enable motor controller and driver applications to enjoy the benefits of GaN power.”JEFF STRANG | GENERAL MANAGER, POWER MANAGEMENT BUSINESS UNIT, QORVO

“Wide bandgap semiconductors such as GaN and SiC are being actively considered in various motor control applications for the power density and efficiency benefits they bring. CGD’s ICeGaN technology offers ease of use and reliability, two crucial factors for motor control and drive designers. We are excited to see the reaction of design engineers when they experience the power of GaN combined with our highly integrated PAC5556A 600V BLDC motor control solution.”GaN brings a variety of benefits, primarily lower losses, which results in higher efficiency, leading to increased power availability and less heat. This reduces the need for complex, bulky, and costly thermal management solutions, resulting in smaller, more powerful systems that have a longer life. GaN also delivers higher torque at low speeds and, therefore, more accurate control. Also, GaN allows high-speed switching, which can reduce audible noise, which is especially valued for domestic items such as ceiling fans, heat pumps, and refrigerators.

In addition to being easy to use, ICeGaN offers several other significant benefits over other GaN devices. The gate drive voltage of ICeGaN is compatible with IGBTs. Because ICeGaN integrates the Miller clamp within the GaN IC, a negative Turn-Off voltage is not required, and low-cost current drivers can be used. Finally, ICeGaN includes a useful current sense function, simplifying circuit design and reducing BOM.

The reference design is available today, and EVK RD5556GaN will be available for purchase in Q324. It will also be shown on CGD’s booth Hall 7 643 at the PCIM exhibition in Nuremberg, Germany, 11-13 June. Qorvo will also exhibit at PCIM, on booth Hall 7 406.

Original – Cambridge GaN Devices