-

Magnachip Semiconductor Corporation announced financial results for the third quarter 2023.

- Revenue of $61.2 million was in-line with guidance.

- Gross profit margin of 23.6% increased 140 basis points from Q2, mainly driven by higher fab utilization.

- GAAP diluted loss per share was $0.13.

- Non-GAAP diluted loss per share was $0.04.

- Completed $5.4 million of stock buybacks during Q3.

- Ended Q3 with a solid balance sheet with $166.6 million cash and no debt.

- The internal separation of Display and Power businesses is expected to be completed and be effective on January 1st, 2024.

YJ Kim, Magnachip’s Chief Executive Officer commented, “Our Q3 results were in-line with our guidance. In our Display business, we have completed the qualification of two DDI chips at our new tier 1 panel maker and are going through the qualification process with two smartphone makers. We are now working on additional Driver ICs that cover broader segments of the smartphone market to include mass market smartphones in addition to the premium models.

Despite near-term market challenges, our outlook for long-term growth remains positive. Our confidence is driven by our strong belief that our display products offer distinct competitive advantages that position us well for success in the rapidly growing OLED market in Asia.”

YJ continued, “In our Power business, our product portfolio is getting stronger as we continue to focus on rolling out next-generation power products to maintain our momentum of design-in/wins. Looking ahead, amid heightened global geopolitical and macroeconomic uncertainty, we expect demand to remain soft, driven by normal Q4 seasonality and inventory correction in industrial end markets.”

Original – Magnachip Semiconductor

-

LATEST NEWS1 Min Read

This week, Siltronic welcomed high-ranking representatives from the Singapore Economic Development Board (EDB) to its Munich headquarters. The delegation, led by Chairman Mr. Png Cheong Boon, included five members of the EDB. This visit underscores the ongoing strong international collaboration with the EDB.

Over the years, Siltronic’s partnership with the EDB has been characterized by strong support and cooperation in many areas, such as workforce development, labor market support, infrastructure development, as well as investment support.

During the meeting, both parties reiterated their shared commitment to collaboration in these vital areas and engaged in discussions regarding strategies for decarbonization.

Siltronic’s latest state-of-the-art 300 mm fab is the largest investment ever made by a German company in Singapore. It showcases the commitment to strengthen and expand the positive relationships with our Singaporean partners.

Dr. Michael Heckmeier, CEO of Siltronic AG, expressed his pleasure to meet the EDB team in person. “The collaboration between Siltronic and the EDB over the years has created significant results. We are proud of these positive collaborative outcomes and look forward to the future.”

Original – Siltronic

-

LATEST NEWS / PRODUCT & TECHNOLOGY / SiC / WBG2 Min Read

BorgWarner has clinched an agreement with a major North American OEM to supply its bi-directional 800V Onboard Charger (OBC) for the automaker’s premium passenger vehicle battery electric vehicle (BEV) platforms. The technology leverages silicon carbide (SiC) power switches for improved efficiency and delivers amplified power density, power conversion and safety compliance. Start of production is slated for January 2027.

“This is a big accomplishment for the team at BorgWarner, highlighting our first OBC win with this OEM and marks the first OBC win in North America,” said Dr. Stefan Demmerle, President and General Manager, BorgWarner PowerDrive Systems.

“Through our world-class power electronics expertise and market leading status for our 800-volt and silicon carbide technology, we are providing a solution to maximize charging power capabilities, extend power densities and enhance efficiencies while catering to differing grid configurations across regions.”

BorgWarner’s OBC technology is installed in electric vehicles to convert alternating current (AC) from the power grid to direct current (DC) to charge batteries. The OBC is capable of powers ranging from 19.2kW single-phase operation to 22kW three-phase operation.

The 19.2kW power level uses two power lines for a single-phase grid connection, which is unique to the U.S. market. The 22kW power level uses a three-phase grid connection and is intended for use in the European market. The 19.2kW single-phase charger is currently the only one of its kind to be introduced into the U.S. market.

The OBC incorporates a bi-directional vehicle-to-load (V2L) operating mode that enables users to use the vehicle battery pack to charge various standalone applications, which is an increasingly desired feature within the industry. Additionally, both the charger hardware and software are designed and produced by BorgWarner.

Original – BorgWarner

-

Qorvo® announced financial results for the Company’s fiscal 2024 second quarter ended September 30, 2023.

Quarterly Highlights

- Grew quarterly revenue 70% sequentially and exceeded the mid-point of revenue guidance by $103 million

- Achieved sequential growth in ACG, CSG and HPA operating segments

- Secured broad-based design wins in all end markets, including major UWB wins in a flagship Android smartphone and an in-vehicle car access platform by a leading German automotive tier one

- Significantly reduced Qorvo inventory while improving Android channel inventory

On a GAAP basis, revenue for Qorvo’s fiscal 2024 second quarter was $1.103 billion, gross margin was 44.4%, operating income was $151 million and diluted earnings per share was $0.99. On a non-GAAP basis, gross margin was 47.6%, operating income was $279 million and diluted earnings per share was $2.39.

Bob Bruggeworth, president and chief executive officer of Qorvo, said, “Qorvo delivered significantly improved financial performance in the September quarter supported by content gains at our largest customer. Each of our operating segments is enjoying multiyear technology upgrade cycles that improve performance and enhance functionality, and Qorvo is critical to enabling these capabilities. The Qorvo team continues to operate very well to secure new customer designs and broaden our opportunities in growth markets.”

Financial Commentary and Outlook

Grant Brown, chief financial officer of Qorvo, said, “Qorvo exceeded the high end of our September quarterly guidance for revenue, gross margin and EPS, reflecting content gains at our largest customer and sequential growth in all three operating segments. Looking forward, our December quarterly guidance reflects seasonal patterns, robust content on customer programs and improved channel inventories. We continue to expect year-over-year revenue growth in fiscal 2024.”

Qorvo’s current outlook for the December 2023 quarter is:

- Quarterly revenue of approximately $1 billion, plus or minus $25 million

- Non-GAAP gross margin between 43% and 44%

- Non-GAAP diluted earnings per share of approximately $1.65 at the midpoint of revenue

Original – Qorvo

-

Axcelis Technologies, Inc. announced financial results for the third quarter of 2023.

Highlights include:

- The Company reported third quarter revenue of $292.3 million, compared to $274.0 million for the second quarter of 2023.

- Operating profit for the quarter was $71.7 million, compared to $63.7 million for the second quarter.

- Net income for the quarter was $65.9 million, or $1.99 per diluted share, compared to $61.6 million, or $1.86 per diluted share in the second quarter.

- Gross margin for the quarter was 44.4%, compared to 43.7% in the second quarter.

- Third quarter ended with systems backlog of $1.2 billion on quarterly bookings of $198 million.

President and CEO Russell Low commented, “Axcelis delivered strong third quarter financial performance due to robust demand for the Purion product family, especially in the silicon carbide power market. Axcelis is the only company with a product line that can deliver complete recipe coverage for all power device applications. We are the technology leader and the supplier of choice providing the best device manufacturing capabilities. This uniquely positions Axcelis to benefit from high growth in this market. Axcelis expects to achieve revenue of greater than $1.1 billion in 2023.”

Executive Vice President and Chief Financial Officer James Coogan said, “We are very pleased with our third quarter 2023 financial results. Revenue, EPS and gross margins all finished well above guidance. Axcelis has had the rare opportunity to grow revenue 20% year over year as well as improve profitability during a significant industry downturn. This is a result of strong product positioning and continued strong execution in a challenging environment.”

Original – Axcelis Technologies

-

LATEST NEWS / PRODUCT & TECHNOLOGY1 Min Read

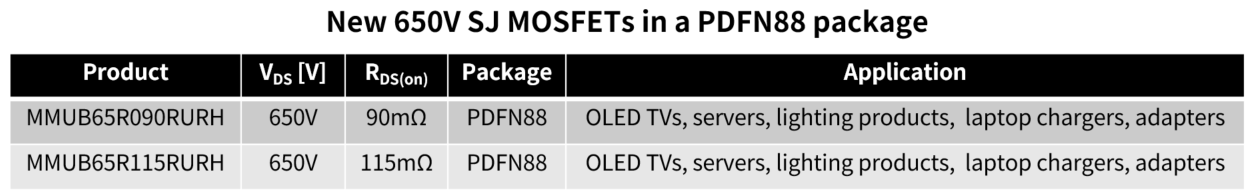

Magnachip Semiconductor Corporation announced that the Company has begun mass production of two new 650V Super Junction Metal-Oxide-Semiconductor Field-Effect Transistors (SJ MOSFETs) offerings.

These two 650V SJ MOSFETs (MMUB65R090RURH, MMUB65R115RURH) utilize an innovative PDFN88 package, which significantly reduces their thickness and size. The thickness has been reduced by approximately 81% compared to D2PAK products and 63% compared to DPAK products, while the overall footprint has been reduced to about 41% of D2PAK SJ MOSFETs.

These new SJ MOSFETs — upgraded by the PDFN88 package — offer excellent design flexibility, efficient heat dissipation, and low RDS(on) (the resistance value between the drain and the source of MOSFETs during on-state operation) characteristics. As a result, they are well-suited for various applications that require compact size and high efficiency, such as OLED TVs, servers, lighting products, laptop chargers and adapters.

“Magnachip will continue to develop high-performance power solutions enhanced by new packaging technology, building upon the successful mass production of these 650V SJ MOSFET products,” said YJ Kim, CEO of Magnachip. “We aim to drive expansion in the electronics market through our extended product portfolio and rigorous quality control.”

Original – Magnachip Semiconductor

-

Littelfuse, Inc. reported financial results for the third quarter ended September 30, 2023:

- Net sales of $607.1 million were down 8% versus the prior year period, and down 11% organically.

- GAAP diluted EPS was $2.30; adjusted diluted EPS was $2.97.

- Cash flow from operations was $161.5 million and free cash flow was $139.8 million.

“In the third quarter, sales and earnings exceeded our expectations, despite pockets of end market softness and ongoing inventory destocking,” said Dave Heinzmann, Littelfuse President and Chief Executive Officer. “Our year-to-date performance underscores the resilience of our business model, strong cash generation, and consistent execution.

Looking ahead, while dynamic macro conditions likely persist, our improved cost structure, healthy balance sheet, and ability to optimize cash flow should position us well into 2024. Our experienced team will continue to leverage our competitive advantages across our evolving and diversified end markets.”

Fourth Quarter of 2023

Based on current market conditions, for the fourth quarter the company expects,- Net sales in the range of $520 to $550 million, adjusted diluted EPS in the range of $1.90 to $2.10 and an adjusted effective tax rate of approximately 18%.

Original – Littelfuse

-

Navitas Semiconductor announced another GaNFast win at Samsung, this time a new 25W charger for the flagship Galaxy S23 smartphone. Gallium nitride (GaN) is a next-gen power-semi technology that is replacing legacy silicon chips in markets from mobile and consumer to data center, solar and EV.

The high-spec Galaxy S23 features a Dynamic AMOLED 2X, 120Hz screen with 1750 nits peak contrast, stretching it’s 1080 x 2340 pixels across 90.1 cm2 of Corning Gorilla Glass. With a Qualcomm Snapdragon 8 Gen 2 chip, up to 512GB / 8GB RAM of storage and triple cameras up to 50 MP, the S23 excels in mobile communication performance.

For power, the S23 features a 3900 mAh Li-Ion battery, and with the GaNFast 25W charger (model EP-T2510) with USB PD 3.0 interface, reaches 50% charge in only 30 minutes, and while in sleep mode, consumes only 5 mW of power. The PD 3.0 specification means that the new charger can power a range of devices from Galaxy Buds2 audio to Galaxy Z Fold5, Galaxy Flip and Galaxy A23.

Navitas’ GaNFast technology is used in a high-frequency, quasi-resonant (HFQR) topology running at 150 kHz. GaNFast leading-edge, high-frequency performance shrinks the charger by more than 30%, and the Navitas device is fully qualified to Samsung’s stringent qualification requirements, with excellent delivery performance, quality and reliability.

“As pioneers in mobile fast charging, Navitas continues to lead the next-gen market, with all 10 of the top 10 mobile OEMs in production with GaNFast products,” said David Carroll, Sr. VP Worldwide Sales. “From 25 W to 20 MW, our expanding range of leading-edge GaN and SiC products cover everything from mobile and consumer to EVs, solar and industrial applications.”

Original – Navitas Semiconductor