-

GlobalFoundries Inc. (GF) announced preliminary financial results for the third quarter ended September 30, 2024.

Key Third Quarter Financial Highlights

- Revenue of $1.739 billion

- Gross margin of 23.8% and Non-IFRS gross margin of 24.7%

- Operating margin of 10.6% and Non-IFRS operating margin of 13.6%

- Net income of $178 million and Non-IFRS net income of $229 million

- Non-IFRS adjusted EBITDA of $627 million

- Cash, cash equivalents and marketable securities of $4.3 billion

- Year to date net cash provided by operating activities of $1,265 million and Non-IFRS adjusted free cash flow of $779 million

“In the third quarter, the GF team continued to execute next generation opportunities with our customers, by securing key design wins across our growing portfolio of essential chip technologies,” said Dr. Thomas Caulfield, President and CEO of GF. “We delivered consistent financial results at the upper end of the guidance ranges we provided in our August earnings release, and as we continue to navigate the ongoing uncertainties facing our industry, we remain on-track to deliver approximately a threefold increase in our year-over-year Non-IFRS adjusted free cash flow generation by the end of 2024.”

Recent Business Highlights

- Building on the longtime relationship between GF and NXP Semiconductors (NXP), the companies announced a new collaboration leveraging GF’s 22FDX® process technology platform and global manufacturing footprint to optimize the power, performance and time-to-market of NXP’s solutions across a range of automotive, IoT and smart mobile devices. GF’s 22FDX chips will be manufactured in Dresden, Germany and Malta, New York, providing NXP geographically diverse supply for their customers.

- Over one thousand customers and partners attended GF’s annual Technology Summit held around the world in Santa Clara, California, Munich, Germany and Shanghai, China, to build deeper relationships and learn how GF’s essential chips play a critical role in realizing “AI Everywhere.”

- GF entered into a strategic technology development and licensing agreement with Finwave Semiconductor, Inc (Finwave), a leading innovator in GaN technology. The collaboration will optimize and scale Finwave’s cutting-edge GaN-on-Si technology to volume production at GF’s 200mm fab in Burlington, Vermont.

Original – GlobalFoundries

-

FINANCIAL RESULTS / LATEST NEWS3 Min Read

Navitas Semiconductor announced unaudited financial results for the third quarter ended September 30, 2024.

“I’m pleased to announce record sales in the mobile fast-charger market plus a completely new GaN platform for 48V AI data centers, EV and AI robotics applications in conjunction with a new, strategic, dual-sourcing partnership with Infineon,” said Gene Sheridan, CEO and co-founder.

`“Despite macro-economic challenges, we continue to grow faster than the market, and the new, low-voltage GaN platform not only opens up new strategic markets, but also brings customers dual-sourcing options from Navitas and Infineon for added confidence to accelerate adoption of GaN into new mainstream, high-volume applications.”

The company also announced a cost-reduction plan that is expected to save $2 million per quarter and streamline the organization with increased focus on AI data center, EV and mobile applications, accelerating the company’s path to profitability. The plan includes a 14% reduction in headcount (approximately 45 employees).

3Q24 Financial Highlights

- Revenue: Total revenue was $21.7 million in the third quarter of 2024, compared to $22.0 million in the third quarter of 2023, and $20.5 million in the second quarter of 2024.

- Loss from Operations: GAAP loss from operations for the quarter was $29.0 million, compared to a loss of $28.6 million for the third quarter of 2023 and a loss of $31.1 million for the second quarter of 2024. On a non-GAAP basis, loss from operations for the quarter was $12.7 million compared to a loss of $8.7 million for the third quarter of 2023, and a loss of $13.3 million in the second quarter of 2024.

- Cash: Cash and cash equivalents were $98.6 million as of September 30, 2024.

Market, Customer and Technology Highlights

- New, Low-voltage (LV) GaN Platform (80-200V): Optimized for 48V systems in AI data center, EV, and motor drive, sampling in Q4 2024, with strategic dual-sourcing partnership with Infineon Technologies. Common specifications (packaging, pin-out, footprint and IP) to accelerate customer adoption of GaN into high-volume, mainstream applications.

- AI Data Center: New 98%-efficient, 8.5 kW AI power supply reference design with high-voltage (HV) GaN+SiC architecture launched as well as proprietary IntelliWeave™ PFC control technique to deliver extreme power density demanded by NVIDIA’s Hopper-Blackwell-Rubin AI GPU roadmap. High-voltage GaNSafe power ICs and Gen-3 ‘Fast’ SiC devices are featured in over 60 active customer projects with direct customers such as Delta, GreatWall, Compuware and LiteON, supplying end-users like AWS, Azure and Google. Our data center production revenues started in Q3 as expected and will continue ramping throughout 2025.

- EV: Leading-edge, trench-assisted, planar-gate Gen-3 ‘Fast’ SiC devices now fully AEC Q101 (automotive) qualified and pushing beyond. Six new on-board and road-side charger design wins in Q3, expected to ramp in 2025 and 2026. Largest pipeline segment, with 200+ projects. New, LV GaN platform optimized for 48V battery EV applications.

- Mobile & Consumer: GaNSlim ICs achieved another 26 design wins in Q3. Three new tier-1 OEM wins expected to deliver revenue ramping Q2’25, adding to the Samsung wins announced in August.

- Appliance & Industrial: Thirty new design wins in Q3, ranging from vacuum cleaners and LED lighting, to solid-state, grid-connected circuit-breakers, multi-kW power supplies and heat pumps. New, LV GaN platform addresses 48V industrial motor drives including AI robotics.

- Solar & Energy Storage: Ten design wins, including at Generac, expected to ramp mid-2025. Next-gen GaN ICs – including Navitas-proprietary, industry-leading bi-directional GaN ICs – continue on track for significant mid-2025 ramp in solar micro-inverters. New, LV GaN doubles TAM in inverters, as complement to HV GaN and SiC.

Fourth quarter 2024 net revenues are expected to be between $18.0 and $20.0 million. Non-GAAP gross margin for the fourth quarter is expected to be 40% plus or minus 50 basis points and non-GAAP operating expenses are expected to be approximately $20.5 million in the fourth quarter of 2024.

Original – Navitas Semiconductor

-

NXP Semiconductors N.V. reported financial results for the third quarter, which ended September 29, 2024.

“NXP delivered quarterly revenue of $3.25 billion, in-line with our overall guidance. While we experienced some strength against our expectations in the Communication Infrastructure, Mobile and Automotive end markets, we were confronted with increasing macro related weakness in the Industrial & IoT market. Our guidance for the fourth quarter reflects broader macro weakness especially in Europe and the Americas. We focus on managing what is in our control enabling NXP to drive resilient profitability and earnings in an uncertain demand environment,” said Kurt Sievers, NXP President and Chief Executive Officer.

Key Highlights for the Third Quarter 2024:

- Revenue was $3.25 billion, down 5 percent year-on-year;

- GAAP gross margin was 57.4 percent, GAAP operating margin was 30.5 percent and GAAP diluted Net Income per Share was $2.79;

- Non-GAAP gross margin was 58.2 percent, non-GAAP operating margin was 35.5 percent, and non-GAAP diluted Net Income per Share was $3.45;

- Cash flow from operations was $779 million, with net capex investments of $186 million, resulting in non-GAAP free cash flow of $593 million;

- During the third quarter of 2024, NXP continued to execute its capital return policy with the payment of $259 million in cash dividends, and the repurchase of $305 million of its common shares. The total capital return of $564 million in the quarter represented 95 percent of third quarter non-GAAP free cash flow. On a trailing twelve month basis, capital return to shareholders represented $2.4 billion or 87 percent of non-GAAP free cash flow. The interim dividend for the third quarter 2024 was paid in cash on October 9, 2024 to shareholders of record as of September 12, 2024. On August 29th, the NXP board of directors authorized an additional $2.0 billion for share repurchases, resulting in a $2.64 billion share repurchase balance at the end of the third quarter. Subsequent to the end of the third quarter, between September 30, 2024 and November 1, 2024, NXP executed via a 10b5-1 program additional share repurchases totaling $117 million;

- On August 20, 2024, ESMC, the previously announced manufacturing joint venture between TSMC, Robert Bosch GmbH, Infineon Technologies AG and NXP Semiconductors N.V. held a groundbreaking ceremony to mark the initial phase of construction of its first semiconductor fab in Dresden, Germany;

- On September 4, 2024, Vanguard International Semiconductor Corporation and NXP Semiconductors N.V. announced the receipt of all necessary governmental approvals from relevant authorities and injected capital to officially establish the previously announced VisionPower Semiconductor Manufacturing Company Pte Ltd (VSMC) manufacturing joint venture. The company will now proceed with the planned construction of VSMC’s first 300mm wafer manufacturing facility;

- On September 10, 2024, NXP announced the Trimension® SR250, the industry’s first single-chip, UWB solution to enable Industrial and IoT applications that integrates on-chip processing capabilities with both short-range UWB-based radar and secure ranging;

- On September 17, 2024, NXP announced the MC33777, the world’s first electric vehicle battery junction box IC that consolidates essential BMS functions into a single device; and

- On September 24, 2024, NXP announced the new i.MX RT700 crossover MCU family, designed to power smart AI-enabled edge devices, such as wearables, consumer medical devices, smart home devices and HMI platforms.

Original – NXP Semiconductors

-

FINANCIAL RESULTS / LATEST NEWS2 Min Read

Magnachip Semiconductor Corporation announced financial results for the third quarter 2024.

YJ Kim, Magnachip’s CEO, commented, “Our Q3 revenue was at the high-end of guidance driven by broad-based growth in our Standard Product businesses, which is comprised of our MSS and PAS businesses. Standard Product revenue increased 25.9% sequentially and 24% year-over-year. Our discrete Power business benefited from leaner inventory in distribution channels as well as new product designs wins resulting in better-than-seasonal growth. In MSS, the strong sequential growth was due to increased demand for products targeted for China smartphone OEMs, automotive displays, and OLED IT.”

YJ Kim added, “Looking ahead, we expect our Standard Product business revenue in Q4 will modestly decline sequentially, which is better than typical seasonality experienced in past years. We reiterate our full-year guidance for double-digit growth in both MSS and PAS businesses in 2024.”

Financial Highlights

- Q3 consolidated revenue was $66.5 million, at the high-end of guidance range of $61.5-66.5 million.

- Q3 standard product business revenue was up 25.9% sequentially.

- Q3 consolidated gross profit margin of 23.3% was in-line with the mid-point of guidance range of 22.5-24.5%.

- Q3 standard product business gross profit margin was 24.4%, up 1.3 percentage points sequentially.

- Ended Q3 with cash of $121.1 million; and an additional non-redeemable short-term financial investment of $30 million.

- Repurchased approximately 0.5 million shares for aggregate purchase price of $2.5 million during the quarter.

Operational Highlights

- Broad-based sequential revenue growth in our PAS business was driven by leaner distribution channels and better-than-typical seasonality. Relative strength was more evident in industrial, computing, and consumer applications. Automotive continues to show strength with additional design wins in Japan and China.

- Started initial DDIC production and shipments for a premium smartphone model from a leading China OEM.

- Received a purchase order from a second leading China smartphone OEM and commenced shipments in October 2024.

- Began sampling our new OLED driver designed with next-generation IP, including sub-pixel rendering (SPR), refined color enhancement, color filter, brightness uniformity control and more than 20% reduction in power consumption than previous generation.

- Power IC revenue increased sequentially, driven primarily by demand for LCD TVs and OLED IT in tablets and notebooks.

Original – Magnachip Semiconductor

- Q3 consolidated revenue was $66.5 million, at the high-end of guidance range of $61.5-66.5 million.

-

STMicroelectronics N.V. (“ST”) reported U.S. GAAP financial results for the third quarter ended September 28, 2024. ST reported third quarter net revenues of $3.25 billion, gross margin of 37.8%, operating margin of 11.7%, and net income of $351 million or $0.37 diluted earnings per share. Jean-Marc Chery, ST President & CEO, commented:

- “Q3 net revenues were in line with the midpoint of our business outlook range. Our revenues, compared to our expectations, were higher in Personal Electronics, declined less in Industrial and were lower in Automotive. Q3 gross margin of 37.8% was broadly in line with the mid-point of our business outlook range.”

- “First nine months net revenues decreased 23.5% year-over-year across all reportable segments, particularly in Microcontrollers, which is impacted by a continuing weakness in the Industrial market. Operating margin was 13.1% and net income was $1.22 billion.”

- “Our fourth quarter business outlook, at the mid-point, is for net revenues of $3.32 billion, decreasing yearover-year by 22.4% and increasing sequentially by 2.2%; gross margin is expected to be about 38%, impacted by about 400 basis points of unused capacity charges.”

- “The midpoint of this outlook translates into full year 2024 revenues of about $13.27 billion, representing a 23.2% year-over-year decrease, in the low-end of the range indicated in the previous quarter, and a gross margin slightly below that provided in such indication.”

- “Based on our current customer order backlog and demand visibility, we anticipate a revenue decline between Q4 2024 and Q1 2025 well above normal seasonality.”

- “We are launching a new company-wide program to reshape our manufacturing footprint accelerating our wafer fab capacity to 300mm Silicon (Agrate and Crolles) and 200mm Silicon Carbide (Catania) and resizing our global cost base. This program should result in strengthening our capability to grow our revenues with an improved operating efficiency resulting in annual cost savings in the high triple-digit million-dollar range exiting 2027.”

Original – STMicroelectronics

-

Renesas Electronics Corporation announced consolidated financial results in accordance with IFRS for the nine months ended September 30, 2024.

Summary of Consolidated Financial Results (Note 1)

Summary of Consolidated Financial Results (Non-GAAP basis) (Note 2)

Three months ended September 30, 2024 Nine months ended September 30, 2024 Billion Yen % of Revenue Billion Yen % of Revenue Revenue 345.3 100.0 1,055.9 100.0 Gross profit 192.8 55.9 595.7 56.4 Operating profit 98.4 28.5 322.5 30.5 Profit attributable to owners of parent 86.0 24.9 288.5 27.3 EBITDA (Note 3) 121.4 35.2 388.0 36.7 Summary of Consolidated Financial Results (IFRS basis)

Three months ended September 30, 2024 Nine months ended September 30, 2024 Billion yen % of Revenue Billion yen % of Revenue Revenue 345.3 100.0 1,055.9 100.0 Gross profit 192.2 55.7 590.6 55.9 Operating profit 57.2 16.6 204.8 19.4 Profit attributable to owners of parent 60.6 17.6 200.3 19.0 EBITDA (Note 3) 109.0 31.6 355.3 33.7 Reconciliation of Non-GAAP gross profit to IFRS gross profit and Non-GAAP operating profit to IFRS operating profit

(Billion yen)

Three months ended September 30, 2024 Nine months ended September 30, 2024 Non-GAAP gross profit

Non-GAAP gross margin192.8

55.9%595.7

56.4%Amortization of purchased intangible assets and depreciation of property, plant and equipment (0.2) (0.8) Stock-based compensation (0.8) (2.1) Other reconciliation items in non-recurring

expenses and adjustments (Note 4)0.4 (2.4) IFRS gross profit

IFRS gross margin192.2

55.7%590.6

55.9%Non-GAAP operating profit

Non-GAAP operating margin98.4

28.5%322.5

30.5%Amortization of purchased intangible assets and depreciation of property, plant and equipment (28.7) (85.0) Stock-based compensation (10.0) (24.9) Other reconciliation items in non-recurring expenses and adjustments (Note 4) (2.4) (7.8) IFRS operating profit

IFRS operating margin57.2

16.6%204.8

19.4%Note 1: All figures are rounded to the nearest 100 million yen.

Note 2: Non-GAAP figures are calculated by removing or adjusting non-recurring items and other adjustments from GAAP (IFRS) figures following a certain set of rules. The Group believes non-GAAP measures provide useful information in understanding and evaluating the Group’s constant business results.

Note 3: Operating profit + Depreciation and amortization.

Note 4: “Other reconciliation items in non-recurring expenses and adjustments” includes the non-recurring items related to acquisitions and other adjustments as well as non-recurring profits or losses the Group believes to be applicable.

Original – Renesas Electronics

-

FINANCIAL RESULTS / LATEST NEWS1 Min Read

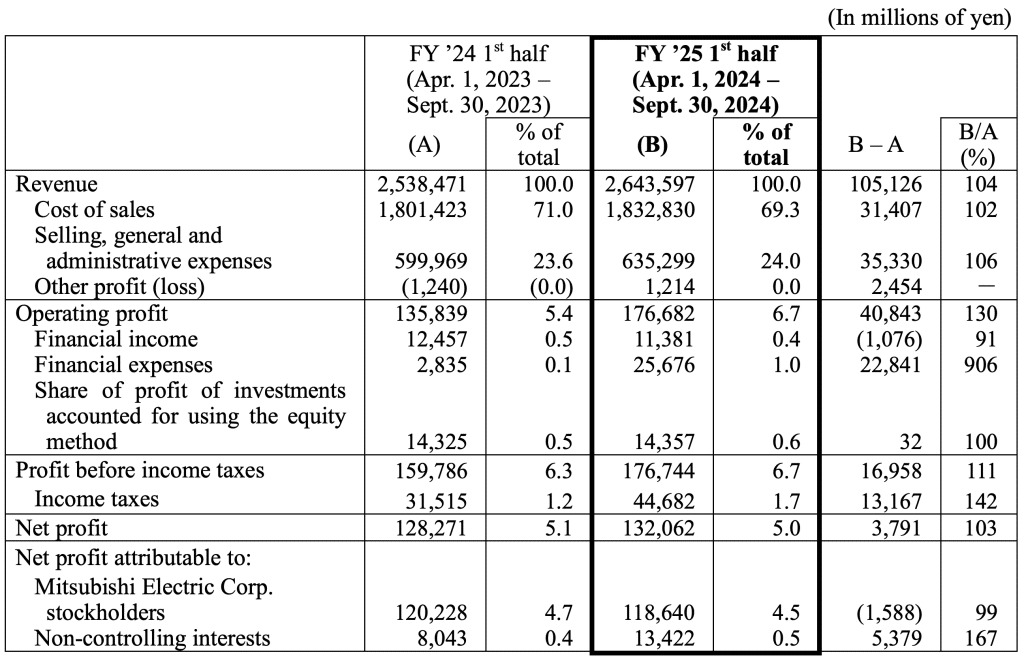

Mitsubishi Electric Corporation announced its consolidated financial results for the second quarter (first half), ended September 30, 2024, of the current fiscal year ending March 31, 2025 (fiscal 2025).

Original – Mitsubishi Electric

-

Qorvo® announced financial results for the Company’s fiscal 2025 second quarter ended September 28, 2024.

On a GAAP basis, revenue for Qorvo’s fiscal 2025 second quarter was $1.047 billion, gross margin was 42.6%, operating income was $9.7 million, and loss per share was $0.18. On a non-GAAP basis, gross margin was 47.0%, operating income was $212.2 million, and diluted earnings per share was $1.88.

Bob Bruggeworth, president and chief executive officer of Qorvo, said, “In the September quarter, ACG successfully supported our largest customer’s seasonal smartphone ramp. In HPA, we expanded our D&A business while building a broad-based business in power management. In CSG, we maintained our leadership in Wi-Fi applications while investing to grow in diverse businesses including automotive solutions and SoCs for ultra-wideband and Matter. HPA and CSG are on pace to achieve mid-teen year-over-year growth in fiscal 2025.”

Grant Brown, chief financial officer of Qorvo, said, “In the September quarter, we exceeded the midpoint of guidance in revenue, gross margin and EPS. Looking forward, the flagship and premium tiers in the smartphone market are holding up well, however, content and ramp profiles vary by model, and we are experiencing unfavorable mix. We expect this to continue in the second half of fiscal 2025. In addition, in the mid and entry tiers of Android 5G smartphones, mix has shifted toward entry-tier 5G at the expense of mid-tier 5G. In our current view, we don’t expect this mix shift in Android 5G from mid-tier to entry-tier to reverse. As a result, we are taking appropriate actions, including factory consolidation and operating expense reductions as well as focusing on opportunities that align with our long-term profitability objectives. We currently expect full-year fiscal 2025 revenue and gross margin will be slightly down versus fiscal 2024.”

Qorvo’s current outlook for the December 2024 quarter is:

- Quarterly revenue of approximately $900 million, plus or minus $25 million

- Non-GAAP gross margin of approximately 45%

- Non-GAAP diluted earnings per share between $1.10 and $1.30

Original – Qorvo

-

Littelfuse, Inc. reported financial results for the third quarter ended September 28, 2024:

- Net sales of $567 million were down 7% versus the prior year period and organically

- GAAP diluted EPS was $2.32 and adjusted diluted EPS was $2.71

- Cash flow from operations was $80 million and free cash flow was $65 million

“In the third quarter, our global teams delivered strong execution and drove sales and earnings above our expectations,” said Dave Heinzmann, Littelfuse President and Chief Executive Officer. “While we see soft end market conditions extending into the fourth quarter, we remain focused on driving operational excellence while serving our global customer base and delivering meaningful new business wins. Our proven growth strategy, diversification efforts and strong technology capabilities position us to deliver top tier long-term stakeholder value.”

Based on current market conditions, for the fourth quarter the company expects Net sales in the range of $510 – $540 million, adjusted diluted EPS in the range of $1.90 – $2.10 and an adjusted effective tax rate of approximately 14%.

Original – Littelfuse

-

onsemi announced results for the third quarter of 2024 with the following highlights:

- Revenue of $1,761.9 million

- GAAP gross margin and non-GAAP gross margin of 45.4% and 45.5%, respectively

- GAAP operating margin and non-GAAP operating margin of 25.3% and 28.2%, respectively

- GAAP diluted earnings per share and non-GAAP diluted earnings per share of $0.93 and $0.99, respectively

- Returned 75% of free cash flow over the last 12 months to shareholders through stock repurchases

“With third-quarter results above expectations, we remain focused on delivering consistent results in the current environment through execution and prudent financial management,” said Hassane El-Khoury, president and CEO, onsemi.

“As power demands continue to rise across our key markets, and the need for greater efficiency becomes paramount, we are investing to win across the entire power spectrum to ensure that onsemi is best positioned to gain share in automotive, industrial and AI data center.”

Original – onsemi