-

LATEST NEWS / PRODUCT & TECHNOLOGY / PROJECTS / SiC / TOP STORIES / WBG2 Min Read

DENSO Corporation and Fuji Electric Co., Ltd. announced that a semiconductor supply plan submitted jointly by the companies has been approved by the Ministry of Economy, Trade and Industry. Under this plan, the companies will take part in joint investment and production of silicon carbide (SiC) power semiconductors to develop and strengthen frameworks for the supply of said semiconductors.

Power semiconductors are vital to the efficient supply of electric power. Demand for power semiconductors has been rising rapidly given that they are used in electrified vehicles, which are being adopted at an accelerated pace amid the push for the decarbonization of society. In comparison to prior silicon semiconductors, SiC power semiconductors are able to deliver superior performance under high temperature, high-frequency, and high-voltage conditions.

These devices are therefore anticipated to make large contributions to reductions in power loses as well as to more compact and lighter-weight designs for battery electric vehicle systems and other power electronics. Accordingly, growth in demand is projected for SiC power semiconductors.

In response to electrification trends, DENSO has advanced SiC technology development projects targeting increased quality and efficiency in relation to everything from wafers and element devices to modules and inverters. Meanwhile, Fuji Electric has constructed extensive frameworks encompassing all tasks spanning from the development of SiC power semiconductor elements that enable increased efficiency and more compact designs for power electronics equipment to mass production of the related modules.

Based on the approved plan, these companies will combine their respective automotive product development and production technology capabilities in a joint effort to expand their capacity for the efficient and stable supply of SiC power semiconductors throughout Japan.

Through this partnership, the companies will contribute to the development of semiconductor supply frameworks within Japan and to the improvement of the international competitiveness of Japan’s domestic semiconductor and automotive industries. In addition, this partnership is anticipated to help advance the decarbonization of society.

Original – Fuji Electric

-

LATEST NEWS / PRODUCT & TECHNOLOGY / TOP STORIES2 Min Read

Power Integrations announced the launch of the SCALE-iFlex™ XLT family of dual-channel plug-and-play gate drivers for operation of single LV100 (Mitsubishi), XHP™ 2 (Infineon), HPnC (Fuji Electric) and equivalent semiconductor modules up to 2300 V blocking voltage for wind, energy storage and solar renewable energy installations.

This single-board driver enables active thermal management of inverter modules for improved system utilization and reduces the bill-of-material count for increased reliability.

Thorsten Schmidt, product marketing manager at Power Integrations commented: “It’s a real challenge to build a single-board gate driver for these ‘new dual’ style IGBT modules. Our compact new SCALE-iFlex XLT gate drivers fit inside the outline of the module, allowing the drivers to be mounted on the module, which gives converter system designers a high degree of mechanical design freedom.”

SCALE-iFlex XLT dual-channel gate drivers feature Negative Temperature Coefficient (NTC) data reporting – an isolated temperature measurement of the power module – which allows accurate thermal management of converter systems. This enables system designers to optimize thermal design and obtain a 25 to 30 percent converter power increase from the same hardware.

The isolated NTC readout also reduces hardware complexity, eliminating multiple cables, connectors and additional isolation barrier crossing circuits. The new gate drivers employ Power Integrations’ SCALE-2 chip set which minimizes component count, enhancing reliability. The gate driver board also protects the power switches in the event of a short-circuit.

Original – Power Integrations

-

LATEST NEWS1 Min Read

Fuji Electric published FY2023 1H Financial Results. In the semiconductor business, the company’s net sales increased year on year due to growth in demand for power semiconductors for electrified vehicles (xEVs).

The growth in sales led to operating results being relatively unchanged year on year, despite the rise in expenses for bolstering power semiconductor production capacity and the increases in material costs.

- Net sales: ¥51.1 billion (up 11% year on year)

- Operating profit: ¥7.1 billion (unchanged year on year)

Original – Fuji Electric

-

LATEST NEWS / TOP STORIES1 Min Read

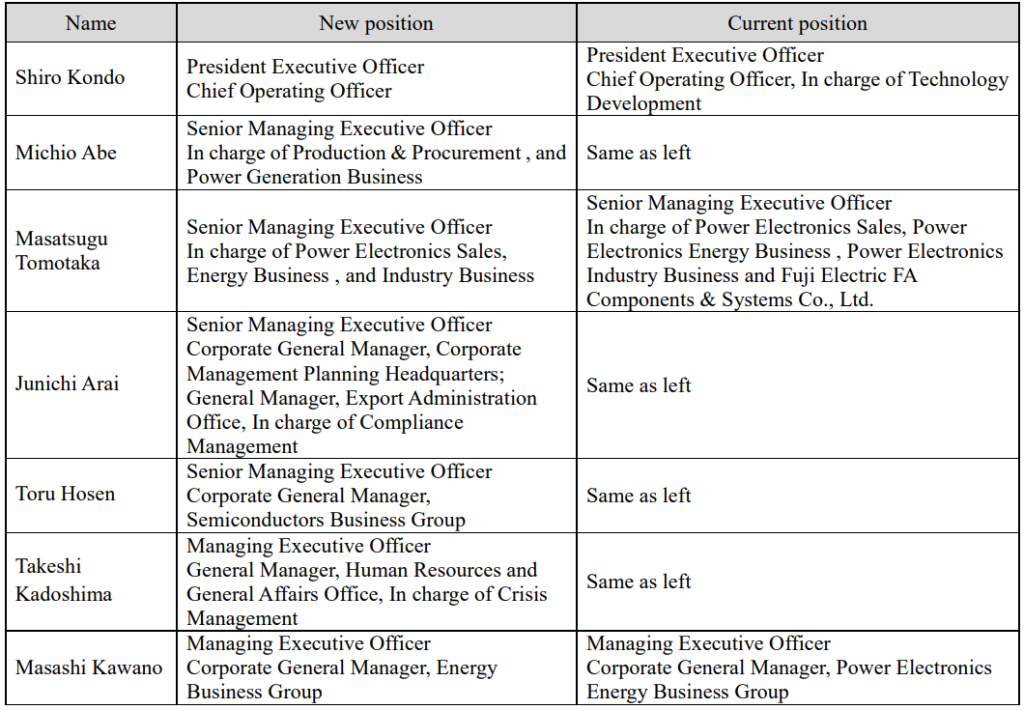

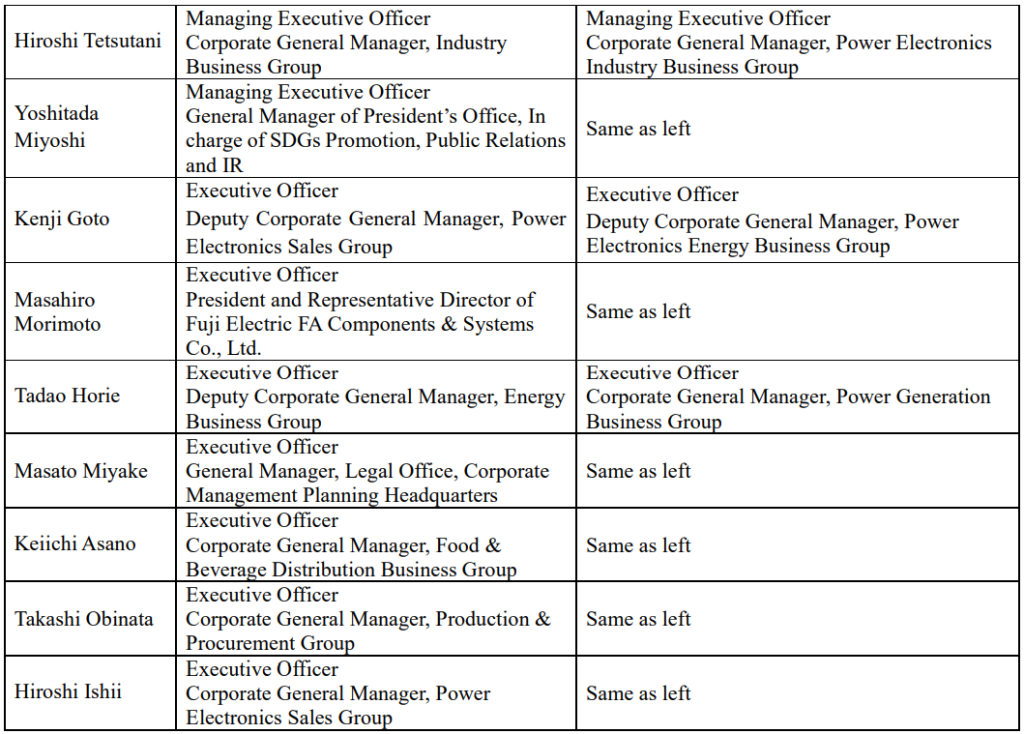

At the meeting of the Board of Directors, Fuji Electric Co., Ltd.’s organizational changes and the appointment of executive officers as of October 1 were resolved. The company will work to strengthen its proposal capabilities in the energy and environment sector by integrating the power electronics and power generation businesses.

Organizational Changes

- The Power Electronics Energy Business Group and the power generation business (thermal & geothermal, hydro, and alternative energy) of the Power Generation Business Group will be integrated to establish the new Energy Business Group.

- The Power Electronics Industry Business Group and the nuclear power business of the Power Generation Business Group will be integrated to establish the new Industry Business Group

Appointment of Executive Officers

Original – Fuji Electric

-

LATEST NEWS / PRODUCT & TECHNOLOGY / Si / TOP STORIES2 Min Read

Fuji Electric Co., Ltd. announced the launch of the P633C Series 3rd-generation small IPMs, which help reduce the power consumption of the equipment on which it is mounted, such as home appliances and machine tools.

IPMs (intelligent power modules) are power semiconductors equipped with a built-in IGBT drive circuit and protection function. They are used for applications including inverters and servo systems. Inverters and servo systems control machine operation by controlling voltage and frequency through power semiconductor switching (turning electricity on and off), but power semiconductors generate power loss and electromagnetic noise during switching.

This product can reduce both the power loss and the electromagnetic noise generated during switching. Using this product in inverters for home appliances or servo systems for machine tools can reduce the power consumption of the equipment on which it is mounted, thereby contributing to the achievement of a decarbonized society.

One way to reduce the power loss that occurs during switching is to speed up the switching operation. Faster switching increases electromagnetic noise, which can cause peripheral devices to malfunction. This product uses the latest 7th-generation IGBT/FWD chips, achieving a 10% reduction of power loss and a reduction of electromagnetic noise to approximately 1/3 compared with conventional products. The trade-off characteristics between power loss and noise are among the best in the industry.

Original – Fuji Electric

-

GaN / LATEST NEWS / PROJECTS / Si / SiC / TOP STORIES / WBG3 Min Read

Power semiconductors companies continue to invest heavily in new factories, production capacity expansions, and R&D centers. Thus, recently the total value of the active investment projects launched since 2021 has surpassed 70 billion USD.

Driven by the pandemic and geopolitics, major power semiconductors companies started to invest more in new factories and joint ventures to have more confidence in their own supply chain in the future.

As of today, it is obvious to see the major split of power semiconductors into three geographical regions – the USA, Europe, and Asia. Asia may as well be divided into several regions with China being the leading investor of all.

Despite the ongoing tensions and export restrictions between the US, Europe, and China related to advanced semiconductors, when it comes to power semiconductors European companies continue to invest in the Chinese market expanding their product capacity or establishing new joint ventures like STMicroelectronics and Sanan Optoelectronics did recently.

Even with some delay, Japanese companies like ROHM, Mitsubishi Electric, Fuji Electric, Renesas Electronics, Toshiba, and others, pushed by their US and European competitors, announced their own projects aimed to secure the capacity on the wafer and device level to correspond to the growing demand for Si and SiC based power semiconductors coming from the electric vehicle and charging, photovoltaics, battery energy storage systems, and the other emerging applications.

If we take a closer look at all projects announced, SiC is the leading technology with over 60% of total investment. Over 25 market leaders announced their plans to invest in silicon carbide.

Thus, ROHM is investing in new production to multiply its SiC capacity in the coming years. Mitsubishi Electric teams up with Coherent to scale manufacturing of SiC power devices on a 200 mm SiC technology platform as one of the steps of their 260 billion yen investment project planned till March 2026.

Infineon Technologies continues to bet on both local European and Asian markets investing in their new fab in Dresden and expanding backend operations in Indonesia. STMicroelectronics continues to invest in WBG semiconductors with the ongoing construction of a new wafer fab in Sicily announced in 2022.

With a global total number of new investment projects of over 80, the US companies Wolfspeed, onsemi, and Microchip Technology, similar to their European counterparts, invest locally, in Europe and Asian markets. Totally the US semiconductor companies announced new projects valued at almost 9 billion USD.

With the US and EU Chips Acts, and similar initiatives in China, Japan, South Korea, and some other countries, it is clear that the investment into power semiconductors industry will continue to reach 100 billion USD soon.