-

FINANCIAL RESULTS / LATEST NEWS2 Min Read

Magnachip Semiconductor Corporation announced financial results for the third quarter 2024.

YJ Kim, Magnachip’s CEO, commented, “Our Q3 revenue was at the high-end of guidance driven by broad-based growth in our Standard Product businesses, which is comprised of our MSS and PAS businesses. Standard Product revenue increased 25.9% sequentially and 24% year-over-year. Our discrete Power business benefited from leaner inventory in distribution channels as well as new product designs wins resulting in better-than-seasonal growth. In MSS, the strong sequential growth was due to increased demand for products targeted for China smartphone OEMs, automotive displays, and OLED IT.”

YJ Kim added, “Looking ahead, we expect our Standard Product business revenue in Q4 will modestly decline sequentially, which is better than typical seasonality experienced in past years. We reiterate our full-year guidance for double-digit growth in both MSS and PAS businesses in 2024.”

Financial Highlights

- Q3 consolidated revenue was $66.5 million, at the high-end of guidance range of $61.5-66.5 million.

- Q3 standard product business revenue was up 25.9% sequentially.

- Q3 consolidated gross profit margin of 23.3% was in-line with the mid-point of guidance range of 22.5-24.5%.

- Q3 standard product business gross profit margin was 24.4%, up 1.3 percentage points sequentially.

- Ended Q3 with cash of $121.1 million; and an additional non-redeemable short-term financial investment of $30 million.

- Repurchased approximately 0.5 million shares for aggregate purchase price of $2.5 million during the quarter.

Operational Highlights

- Broad-based sequential revenue growth in our PAS business was driven by leaner distribution channels and better-than-typical seasonality. Relative strength was more evident in industrial, computing, and consumer applications. Automotive continues to show strength with additional design wins in Japan and China.

- Started initial DDIC production and shipments for a premium smartphone model from a leading China OEM.

- Received a purchase order from a second leading China smartphone OEM and commenced shipments in October 2024.

- Began sampling our new OLED driver designed with next-generation IP, including sub-pixel rendering (SPR), refined color enhancement, color filter, brightness uniformity control and more than 20% reduction in power consumption than previous generation.

- Power IC revenue increased sequentially, driven primarily by demand for LCD TVs and OLED IT in tablets and notebooks.

Original – Magnachip Semiconductor

- Q3 consolidated revenue was $66.5 million, at the high-end of guidance range of $61.5-66.5 million.

-

FINANCIAL RESULTS / LATEST NEWS2 Min Read

Magnachip Semiconductor Corporation announced financial results for the second quarter 2024.

YJ Kim, Magnachip’s CEO, commented, “Our Q2 revenue was above the mid-point of guidance and gross margin was better than expected. Revenue in our Standard Products Business, which is comprised of our MSS and PAS businesses, increased sequentially by double digits in Q2. We benefited from a recovery in our Power business, increased demand for OLED drivers for China smartphones and European autos, and an upturn in Power IC demand for OLED IT panels and LED TVs.”

YJ Kim added, “Looking ahead, we currently expect Standard Product Business revenue will increase sequentially once again in Q3, driven by leaner distribution channels in Power, as well as seasonality, and an increase in OLED and Power IC businesses.”

Financial Highlights

- Q2 consolidated revenue was $53.2 million, above the mid-point of guidance range of $49-54 million.

- Q2 standard product business revenue was up 11.6% sequentially.

- Q2 consolidated gross profit margin was 21.8%, above the upper end of guidance range of 17-19%.

- Q2 standard product business gross profit margin was 23.1%, up nearly two percentage points sequentially.

- Ended Q2 with cash of $132.5 million; and also have an additional short-term financial investment of $30 million.

- Repurchased approximately 0.5 million shares for aggregate purchase price of $2.3 million during the quarter.

Operational Highlights

- Held formal opening ceremony in China for newly formed subsidiary, Magnachip Technology Company, Ltd. (MTC).

- Secured a purchase commitment for OLED driver targeted for a premium smartphone OEM; mass production and revenue currently expected to begin by year-end.

- Delivered samples of our next-generation OLED driver to a panel supplier for a leading Chinese smartphone OEM’s winter 2024 model, now in the final design validation phase.

- Taped out a new OLED driver designed with next-generation IP including sub-pixel rendering (SPR), refined color enhancement, color filter, brightness uniformity control and more than 20% reduction in power consumption than previous generation.

- Sampled our first OLED smartwatch DDIC in Q2 following a Q1 tape-out, demonstrating our expansion into new, adjacent markets.

- Power IC revenue increased sequentially, driven primarily by demand for LCD TVs and OLED IT monitors.

- Sequential revenue growth in PAS segment was driven by industrial, communication and consumer applications. Automotive rebounded with new design wins in Japan and China.

- Launched new 75A/1200V IGBT for a design opportunity in solar applications; expected to begin mass production in the second half of the year.

Original – Magnachip Semiconductor

- Q2 consolidated revenue was $53.2 million, above the mid-point of guidance range of $49-54 million.

-

Magnachip Semiconductor Corporation announced financial results for the first quarter 2024.

YJ Kim, Magnachip’s Chief Executive Officer, commented, “In Q1 we started the initial revenue ramp for OLED DDICs for the after-service market, and we were awarded two new designs targeted for a leading China smartphone OEM and also for a leading European EV maker. Our Power Analog Solutions (PAS) business revenue grew 12% sequentially driven by smartphones, e-motors, consumer appliances and server power applications, and we now are launching a slate of next-gen power products to help sustain our momentum. We also are encouraged that the power channel inventory showed signs of improvement in the first quarter.”

YJ continued, “Looking forward, we expect sequential revenue growth in Mixed-Signal Solutions (MSS) and PAS to continue in Q2 and we reiterate our prior full-year guidance for double digit growth in both MSS and PAS businesses.”

Financial Highlights

- Q1 consolidated revenue was $49.1 million, within our guidance range of $46-51 million.

- Q1 standard product business revenue was up 10.6% sequentially.

- Q1 consolidated gross profit margin was 18.3%, within our guidance range of 17-20%.

- Q1 standard product business gross profit margin was down 170 basis points sequentially, mostly due to lower Gumi fab utilization driven by the wind-down of Transitional Foundry Services.

- Ended Q1 with $29.7 million in long-term borrowing and $171.6 million in cash.

- Repurchased approximately $4.1 million or 0.6 million shares during the quarter.

Operational Highlights

- Secured a new high-end smartphone OLED DDIC design for a top tier China smartphone OEM.

- Secured a new EV automotive OLED DDIC design win for a leading European automaker.

- Began operations of our new China entity called Magnachip Technology Company (MTC). Our China headquarters is now up and running.

- Started initial ramp in Q1 for our first-generation OLED DDIC chip for China for the after-service market.

- Captured our first medium voltage MOSFET automotive design-win for an electric cooling fan with a China-based SUV supplier, as well as an additional automotive power steering related win in Korea.

- Began to see initial signs of inventory reductions in the distribution channel for our Power Analog Solutions products.

Original – Magnachip Semiconductor

- Q1 consolidated revenue was $49.1 million, within our guidance range of $46-51 million.

-

Magnachip Semiconductor Corporation announced the release of its new 40V MXT MV MOSFET. With this latest addition, the Company now offers 13 MOSFET and IGBT products for a wide range of automotive applications.

As the automotive industry adopts advanced technologies such as autonomous driving and enhanced infotainment systems, the demand for high-efficiency power solutions increases. According to Omdia, a global market research firm, the automotive power discrete market is projected to grow 14% annually from 2024 to 2027.

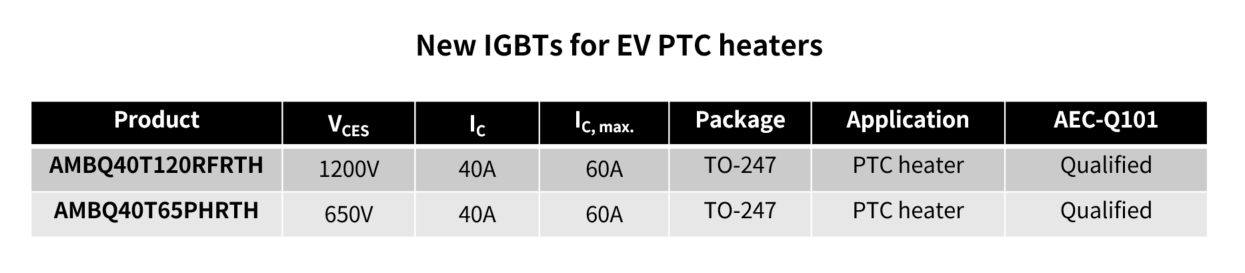

Magnachip entered the automotive sector in April 2022 with its first 40V MOSFET and has since broadened its product offerings by releasing 30V, -40V (P-channel MOSFET), 60V, and 250V MOSFETs for vehicles. In September 2023, the Company introduced 650V and 1200V IGBTs for positive temperature coefficient heaters and e-compressors for automotive. In the last two years, Magnachip’s power products have been integrated into vehicles of major automotive manufacturers in the United States, Korea, Japan and China.

Leveraging its technological capabilities, Magnachip now unveils this 40V MXT MV MOSFET (AMDD040N055RH) in the Decawatt Package (DPAK). The new MOSFET offers exceptional versatility for various automotive applications, such as motor control systems or power seat modules and electric stability control systems for reverse battery protection.

“Magnachip is committed to supplying premium products that meet the evolving demands of the automotive sector,” said YJ Kim, CEO of Magnachip. “Our technical innovation, coupled with a steady supply and a comprehensive range of product offerings, will strengthen our foothold in the automotive industry and broaden our global market presence.”

Original – Magnachip Semiconductor

-

Magnachip Semiconductor Corporation announced financial results for the fourth quarter and full-year 2023.

YJ Kim, Magnachip’s Chief Executive Officer commented, “As we reflect on the past year and look ahead, we’re shaping our future with the transformation of our business. First, we have shifted our Display business to be laser-focused on the burgeoning OLED market in China and our efforts there are already showing promising results. We now have two design-wins and a dedicated team on the ground to help build on this momentum. Additionally, we are working to optimize our Gumi Fab to transition from lower-margin Transitional Foundry Services to higher-margin Power products. Finally, we’ve restructured our company to streamline operations, enhance shareholder value and increase transparency for our investors with the completion of our legal separation of historical Display and Power businesses into MSS and PAS.”

YJ continued, “Looking ahead, for full year 2024, we currently expect double-digit revenue growth in both the newly organized MSS and PAS businesses. We currently expect total consolidated company revenue for full year 2024 to remain relatively flat to slightly up due to the phase-out of Transitional Foundry Services. We also anticipate PAS gross margin to be challenged during the transition period while we convert the Transitional Foundry Services capacity to Power capacity, but we are committed to navigating this period with a clear focus on long-term value creation for shareholders.”

Financial Highlights

- Q4 revenue of $50.8 million was near the low-end of our guidance range.

- Q4 gross profit margin was 22.7%, near the low-end of our guidance range.

- Ended Q4 with no debt and cash of $158.1 million.

- Repurchased approximately $8.2 million of stock during the quarter.

- Full-year revenue of $230.1 million decreased 31.9% YoY.

- Full-year gross profit margin was 22.4%, down 760 bps YoY.

Operational Highlights

- Secured 1st design-win and began initial shipment in Q4 for first generation OLED DDIC for after-service market.

- Secured 2nd design-win following quarter close with leading Chinese smartphone OEM for spring launch.

- Entered into strategic commercial partnership with Chinese watch solution provider to collaborate on OLED smartwatch display market.

- Display and Power business separation and entity restructuring completed effective with the start of 2024; New businesses MSS (Mixed-Signal Solutions) and PAS (Power-Analog Solutions)

Original – Magnachip Semiconductor

-

Magnachip Semiconductor Corporation announced financial results for the third quarter 2023.

- Revenue of $61.2 million was in-line with guidance.

- Gross profit margin of 23.6% increased 140 basis points from Q2, mainly driven by higher fab utilization.

- GAAP diluted loss per share was $0.13.

- Non-GAAP diluted loss per share was $0.04.

- Completed $5.4 million of stock buybacks during Q3.

- Ended Q3 with a solid balance sheet with $166.6 million cash and no debt.

- The internal separation of Display and Power businesses is expected to be completed and be effective on January 1st, 2024.

YJ Kim, Magnachip’s Chief Executive Officer commented, “Our Q3 results were in-line with our guidance. In our Display business, we have completed the qualification of two DDI chips at our new tier 1 panel maker and are going through the qualification process with two smartphone makers. We are now working on additional Driver ICs that cover broader segments of the smartphone market to include mass market smartphones in addition to the premium models.

Despite near-term market challenges, our outlook for long-term growth remains positive. Our confidence is driven by our strong belief that our display products offer distinct competitive advantages that position us well for success in the rapidly growing OLED market in Asia.”

YJ continued, “In our Power business, our product portfolio is getting stronger as we continue to focus on rolling out next-generation power products to maintain our momentum of design-in/wins. Looking ahead, amid heightened global geopolitical and macroeconomic uncertainty, we expect demand to remain soft, driven by normal Q4 seasonality and inventory correction in industrial end markets.”

Original – Magnachip Semiconductor

-

LATEST NEWS / PRODUCT & TECHNOLOGY1 Min Read

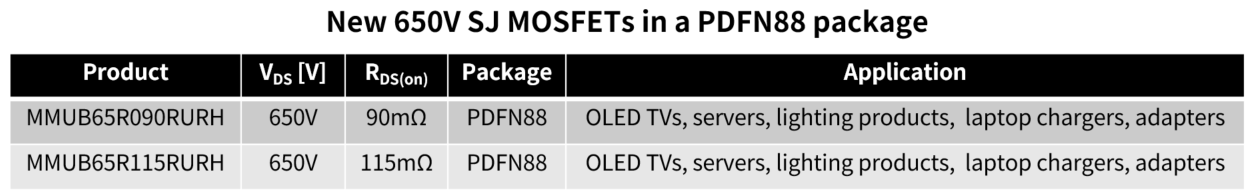

Magnachip Semiconductor Corporation announced that the Company has begun mass production of two new 650V Super Junction Metal-Oxide-Semiconductor Field-Effect Transistors (SJ MOSFETs) offerings.

These two 650V SJ MOSFETs (MMUB65R090RURH, MMUB65R115RURH) utilize an innovative PDFN88 package, which significantly reduces their thickness and size. The thickness has been reduced by approximately 81% compared to D2PAK products and 63% compared to DPAK products, while the overall footprint has been reduced to about 41% of D2PAK SJ MOSFETs.

These new SJ MOSFETs — upgraded by the PDFN88 package — offer excellent design flexibility, efficient heat dissipation, and low RDS(on) (the resistance value between the drain and the source of MOSFETs during on-state operation) characteristics. As a result, they are well-suited for various applications that require compact size and high efficiency, such as OLED TVs, servers, lighting products, laptop chargers and adapters.

“Magnachip will continue to develop high-performance power solutions enhanced by new packaging technology, building upon the successful mass production of these 650V SJ MOSFET products,” said YJ Kim, CEO of Magnachip. “We aim to drive expansion in the electronics market through our extended product portfolio and rigorous quality control.”

Original – Magnachip Semiconductor

-

Magnachip Semiconductor Corporation announced the launch of two new 150V MXT MV Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs), using its 8th-generation trench MOSFET technology.

Energy efficiency is crucial in high-power devices for reducing power consumption and ensuring stability. These newly released 8th-generation 150V MXT MV MOSFETs (MDES15N056PTRH, MDU150N113PTVRH) were developed by leveraging Magnachip’s cutting-edge trench MOSFET technology. In particular, the RDS(on) (the resistance value between the drain and the source of MOSFETs during on-state operation) of MDES15N056PTRH was reduced by 22% compared to the previous generation, thereby significantly enhancing energy efficiency in applications.

By improving the core cell and termination design, the Figure of Merit (FOM: RDS(on) x Qg) of MDES15N056PTRH and MDU150N113PTVRH has been improved by 23% and 39%, respectively, compared to the previous version. Furthermore, the adoption of surface-mount type packages, such as D2PAK-7L (TO-263-7L) and PDFN56, reduces MOSFET sizes, enabling flexible design of various applications, such as motor controllers, battery management systems (BMSs), residential solar inverters and industrial power supplies.

“Following the introduction of five 8th-generation 200V and 150V MOSFETs last year, we are pleased to now release two additional 150V MXT MV MOSFET product offerings in new packages,” said YJ Kim, CEO of Magnachip. “Magnachip will continue to expand its high-efficiency MXT MOSFET product portfolio, including new releases based on 180nm microfabrication technology in the near future.”

Original – Magnachip Semiconductor

-

Magnachip Semiconductor Corporation received a letter of resignation, dated September 5, 2023, from Mr. Mel Keating, a member of the board of directors of the Company, whose resignation was accepted by the Board and effective as of September 5, 2023.

Now that the Company has announced its plan to separate its Display and Power operations into two distinct legal entities, Mr. Keating has decided that, after over 7 years of service as a member of the Board, during which time he led the Audit Committee and the Strategic Review Committee, and given other important and time consuming business obligations, it was the right time to conclude his service to the company.

Mr. Keating’s resignation is not due to any disagreement with the company over any of its financial reporting, operations, policies or practices.

Original – Magnachip Semiconductor