-

Mitsubishi Electric Corporation released its consolidated financial results for the third quarter and the first nine months of fiscal year 2025, ending December 31, 2024. The company reported a revenue of ¥4,000.4 billion, marking a 5.8% increase from the same period in the previous fiscal year. This growth is attributed to strong performances in the Infrastructure and Industry & Mobility segments.

The cost of sales was ¥2,771.0 billion, resulting in a gross profit of ¥1,229.3 billion. Selling, general, and administrative expenses totaled ¥951.4 billion. The company also reported other profits amounting to ¥25.7 billion, leading to an operating profit of ¥303.6 billion, a significant 36.5% increase year-over-year.

Financial income stood at ¥16.9 billion, while financial expenses were ¥5.4 billion. The share of profit from investments accounted for using the equity method was ¥29.6 billion. Consequently, profit before income taxes reached ¥344.6 billion. After accounting for income taxes of ¥76.8 billion, the net profit was ¥267.8 billion, a 36.4% increase from the previous year. Net profit attributable to Mitsubishi Electric Corporation stockholders was ¥248.1 billion, with ¥19.7 billion attributable to non-controlling interests.

In terms of comprehensive income, the company reported ¥340.8 billion, up from ¥315.6 billion in the previous year. This includes other comprehensive income of ¥73.0 billion, primarily due to exchange differences on translating foreign operations and changes in the fair value of financial assets.

As of December 31, 2024, total assets were ¥6,234.8 billion, an increase of ¥67.5 billion from March 31, 2024. Current assets were ¥3,636.7 billion, with cash and cash equivalents totaling ¥734.0 billion. Non-current assets amounted to ¥2,598.2 billion.

Total liabilities decreased by ¥93.2 billion to ¥1,745.9 billion. Current liabilities were ¥1,745.9 billion, including trade payables of ¥574.6 billion and contract liabilities of ¥325.8 billion. Non-current liabilities stood at ¥1,745.9 billion. Equity attributable to Mitsubishi Electric Corporation stockholders increased by ¥161.0 billion to ¥4,161.0 billion, while non-controlling interests rose by ¥0.3 billion to ¥327.9 billion.

These results reflect Mitsubishi Electric’s robust performance across its business segments and its strategic focus on growth and profitability.

The Energy and Electric Systems segment experienced a revenue increase due to strong demand for power generation and distribution systems, particularly in renewable energy sectors. The Industrial Automation Systems segment also saw growth, driven by increased capital investments in factory automation and robust sales in the automotive sector. Conversely, the Information and Communication Systems segment faced a decline in revenue, attributed to decreased demand for communication systems.

In its consolidated financial results Mitsubishi Electric reported notable performance in its Semiconductor & Device segment. This segment encompasses the company’s semiconductor operations, including power devices and other electronic components.

Third Quarter Semiconductor & Device Performance:

- Revenue: The Semiconductor & Device segment achieved a revenue of ¥67.8 billion in Q3 FY25, reflecting a slight decrease of ¥1.9 billion compared to the same period in the previous fiscal year.

- Operating Profit: The segment reported an operating profit of ¥8.4 billion, marking an increase of ¥0.5 billion year-over-year. The operating profit margin improved to 12.5%, up from 11.3% in Q3 FY24.

Original – Mitsubishi Electric

-

LATEST NEWS / PROJECTS / SiC / WBG2 Min Read

Mitsubishi Electric Corporation will begin developing a prototype to demonstrate a junction-temperature estimation technology for power modules, which it is pursuing as a partner in the European Union’s Horizon Europe project aimed at developing advanced power modules and improving cost efficiency of renewable-energy power-generation.

The company is participating through its European subsidiary Mitsubishi Electric R&D Centre Europe B.V., which has joined the project, called Flagship Advanced Solutions for Condition and Health Monitoring in Power Electronics (FLAGCHIP).

In the global effort to expand the introduction of renewable energy to support carbon neutrality, the need to upgrade the reliability and maintenance of electronic devices for power conversion has become increasingly important. In particular, attention is being focused on technological innovations aimed at strengthening power module reliability and improving data acquisition and analysis methods to accurately determine degradation conditions in order to carry facilitate more timely maintenance.

The FLAGCHIP project currently involves 11 companies and academic institutions from nine European countries engaged in developing advanced power modules, condition and health monitoring technologies, and devising methods for calculating cost efficiency of renewable-energy power-generation systems and reducing associated costs. Demonstrations of wind-power and solar-power generation systems using these technologies and methods will be conducted at test facilities owned by project partners in Norway and France.

Mitsubishi Electric will be in charge of demonstrating a technology that estimates the junction temperature of silicon carbide metal-oxide-semiconductor field-effect transistor (SiC-MOSFET) semiconductor chips inside the power module, which will provide necessary data for accurately estimating module degradation.

Starting in October 2026, the demonstration will use the newly developed prototype at a test facility in France where direct current (DC) voltage is converted to a specific DC voltage for a wind-power generation system.

Original – Mitsubishi Electric

-

Mitsubishi Electric Corporation announced that it will invest approximately 10 billion yen to construct a new facility for the assembly and inspection of power semiconductor modules at its Power Device Works in Fukuoka Prefecture, Japan. The plant, which was originally announced on March 14, 2023, is scheduled to begin operations in October 2026.

As the primary facility for assembling and inspecting power semiconductor modules, the plant will consolidate previously dispersed assembly and inspection production lines within the site to streamline production, from the incoming of components through manufacturing and final shipment. New systems will be implemented to automate the management of manufacturing processes and the transportation of products for improved productivity. In addition, the company’s integrated system covering everything from design, development and production technology verification to manufacturing will be strengthened to enhance product development.

Mitsubishi Electric expects the new plant to support its rapid and stable supply of products to meet market needs in response to the anticipated increases in demand for power semiconductors. As a result, the company envisions contributing to the energy efficiency of power-electronics devices in various applications, as well as the Green Transformation (GX).

In connection with the construction of the new plant, Fukuoka Prefecture has designated Mitsubishi Electric for the second time as a corporate entity of the Green Asia International Strategic Comprehensive Special Zone. By utilizing the preferential incentives of this special zone, Mitsubishi Electric will be able to strengthen the production capabilities of its Power Device Works’ new plant in Fukuoka Prefecture.

Original – Mitsubishi Electric

-

FINANCIAL RESULTS / LATEST NEWS1 Min Read

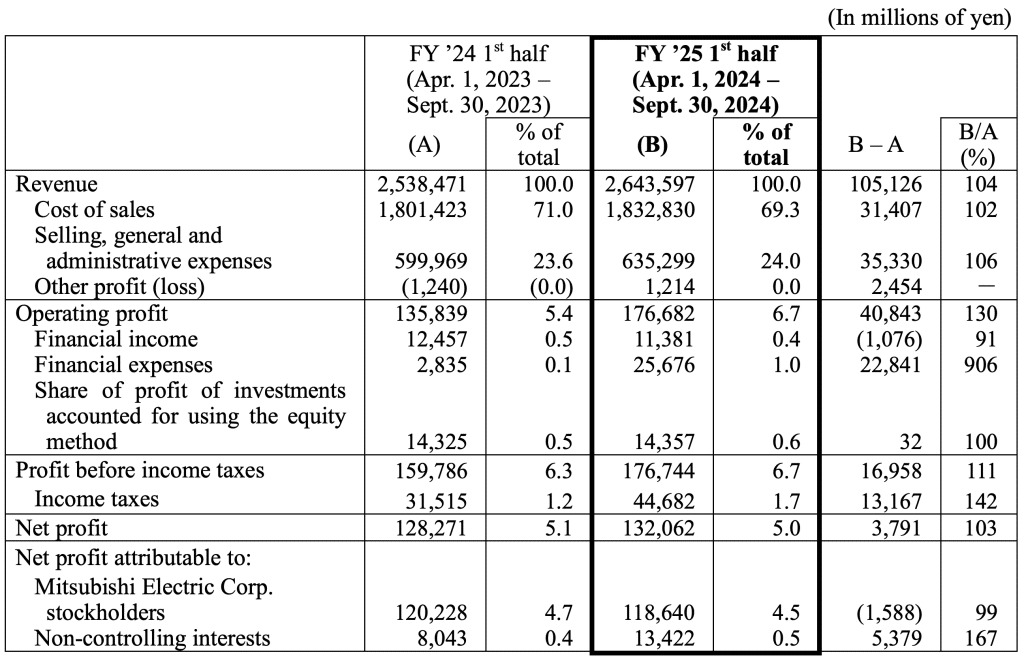

Mitsubishi Electric Corporation announced its consolidated financial results for the second quarter (first half), ended September 30, 2024, of the current fiscal year ending March 31, 2025 (fiscal 2025).

Original – Mitsubishi Electric

-

FINANCIAL RESULTS / LATEST NEWS2 Min Read

Mitsubishi Electric Corporation announced its consolidated financial results for the first quarter, ended June 30, 2024, of the current fiscal year ending March 31, 2025 (fiscal 2025).

- Q1 FY25: Revenue ¥1,286.4 bn (+¥66.1 bn YoY), Operating Profit ¥58.6 bn (-¥2.3 bn YoY)

- Revenue achieved a new record high due primarily to an increase in the infrastructure segment and the impact of the weaker yen.

- Operating profit remained at the same level YoY due to the impact of a decrease in volume in the factory automation systems business and the impact of rising material and other procurement costs.

- FY25 forecast: Revenue ¥5,390.0 bn (+¥90.0 bn compared to the previous forecast), Operating Profit ¥400.0 bn (unchanged from the previous announcement)

- The revenue forecast has been revised upward partly due to a reconsideration of foreign exchange rates, while incorporating the impact of the delay in market recovery for factory automation systems.

- The company will steadily implement initiatives to achieve earnings targets, including improvements in product prices to reflect the impact of rising procurement costs.

Semiconductor & Device Segment

Revenue (YoY), Billions of yen Operating profit (YoY),

Billions of yenOperating profit margin (YoY), Billions of yen 74.5(+6.3) 11.5(+4.8) 15.5%(+5.7pt) - The market saw robust demand for power modules used in railway & power transmission applications.

- Orders decreased YoY due primarily to a decrease in power modules. Revenue increased YoY due mainly to the impact of the weaker yen as well as an increase in power modules used in automotive applications and other factors.

- Operating profit increased YoY due mainly to increased revenue.

Original – Mitsubishi Electric

-

LATEST NEWS1 Min Read

Mitsubishi Electric Corporation announced that it will launch a web-based service on June 28 to provide data on the design and validation of a proprietary prototype inverter equipped with a module containing three LV100 insulated gate bipolar transistors (IGBTs), aiming to help customers accelerate their development of high-power inverters for applications such as photovoltaic power-generation systems.

Customers involved in developing prototype inverter systems with LV100 packages are expected to use reference information provided by the service to reduce their design, manufacture and validation workloads. The service will be exhibited at major trade shows, including Power Conversion Intelligent Motion (PCIM) Europe 2024 in Nuremberg, Germany from June 11 to 13.

The prototype inverter includes a package of three parallel LV100 industrial IGBTs in a module measuring 100mm x 140mm module, typical of those used in high-power inverter systems. The reference data will include design data, such as geometry, component layout and electrical circuitry, as well as evaluation data such as temperatures, short-circuit protection, current balance and computer-aided engineering (CAE) validation results.Original – Mitsubishi Electric