-

LATEST NEWS / PRODUCT & TECHNOLOGY / Si3 Min Read

The latest onsemi 7th generation 1200V QDual3 Insulated Gate Bipolar Transistor (IGBT) power modules offer increased power density and deliver up to 10% more output power than other available competing products. Based on the latest Field Stop 7 (FS7) IGBT technology, the 800-amp (A) QDual3 module delivers industry-leading efficiency to reduce system costs and simplify designs.

In a 150KW inverter, the QDual3 module will dissipate 200 watts (W) less in losses compared to the closest competition, significantly reducing heatsink size. QDual3 is engineered to work under harsh conditions and is ideal for high-power electronics converters such as central inverters in solar farms, energy storage systems (ESS), commercial agricultural vehicles (CAVs) and industrial motor drives.

Currently, two products are available depending on the applications – NXH800H120L7QDSG and SNXH800H120L7QDSG.

Increasing renewable energy adoption amplifies the need for solutions that can manage peak demand and ensure continuous power supply. Peak shaving, the practice of reducing electricity use during peak hours, is essential for maintaining electric grid stability and reducing costs. Using the QDual3 modules, manufacturers can construct a solar inverter and ESS that output more power in the same system size, enabling more efficient energy management and storage capabilities, and allowing for a smoother integration of solar power into the grid.

The modules also mitigate the intermittency of solar energy by storing excess power in an ESS, ensuring a reliable and consistent energy flow. For large systems, the modules can be paralleled to increase the output power up to a couple of MWs and compared to traditional 600 A module solutions, the 800 A QDual3 significantly reduces the module quantity, greatly simplifying design complexity and cutting system costs.

The QDual3 IGBTs module features an 800 A half-bridge configuration that integrates the latest Gen7 trench Field Stop IGBT and diode technology using onsemi’s advanced packaging techniques to reduce switching and conduction losses.

With FS7 technology, the die size is reduced by 30%, allowing more die per module, increasing the power density to enable the maximum current capacity up to 800 A or higher. With an IGBT Vce(sat) as low as 1.75V (175°C) and low Eoff, the 800 A QDual3 module dissipates 10% lower energy losses than the next-best alternative. The modules also meet the stringent standards required of an automotive application.

“Increased electrification of commercial fleets such as trucks and busses and the need of renewable energy sources demand solutions that can generate, store and distribute power more efficiently. Transferring energy from renewable sources to the grid, storage systems and to downstream loads with the lowest power losses possible is increasingly critical,” said Sravan Vanaparthy, vice president, Industrial Power Division, Power Solutions Group, onsemi. “With its industry-standard pin-out and market-leading efficiencies, QDual3 enables power electronics designers to plug and play these modules for an immediate performance boost in their systems.”

Original – onsemi

-

onsemi announced results for the first quarter of 2024 with the following highlights:

- Revenue of $1,862.7 million

- GAAP gross margin and non-GAAP gross margin of 45.8% and 45.9%, respectively

- GAAP operating margin and non-GAAP operating margin of 28.2% and 29.0%, respectively

- GAAP diluted earnings per share and non-GAAP diluted earnings per share of $1.04 and $1.08, respectively

- Returned ~100% of free cash flow over last twelve months to shareholders through stock repurchases

“The structural changes we have made to the business over the last three years have enabled us to sustain our gross margin despite challenging market conditions,” said Hassane El-Khoury, president and chief executive officer of onsemi. “In the current environment, we remain focused on execution while investing for our long-term growth. As power continues to play a critical role in the world’s increasing energy demands, efficiency is paramount, and we are positioned to continue to gain share with our portfolio of industry-leading power and sensing technologies.”

Selected financial results for the quarter are shown below with comparable periods (unaudited):

GAAP Non-GAAP (Revenue and Net Income in millions) Q1 2024 Q4 2023 Q1 2023 Q1 2024 Q4 2023 Q1 2023 Revenue $ 1,862.7 $ 2,018.1 $ 1,959.7 $ 1,862.7 $ 2,018.1 $ 1,959.7 Gross Margin 45.8 % 46.7 % 46.8 % 45.9 % 46.7 % 46.8 % Operating Margin 28.2 % 30.3 % 28.8 % 29.0 % 31.6 % 32.2 % Net Income attributable to ON Semiconductor Corporation $ 453.0 $ 562.7 $ 461.7 $ 464.5 $ 540.9 $ 523.7 Diluted Earnings Per Share $ 1.04 $ 1.28 $ 1.03 $ 1.08 $ 1.25 $ 1.19 Revenue Summary (in millions) (Unaudited) Three Months Ended Business Segment(1) Q1 2024 Q4 2023 Q1 2023 Sequential Change Year-over-Year Change PSG $ 874.2 $ 965.5 $ 860.9 (9 )% 2 % AMG 697.0 744.9 744.7 (6 )% (6 )% ISG 291.5 307.7 354.1 (5 )% (18 )% Total $ 1,862.7 $ 2,018.1 $ 1,959.7 (8 )% (5 )% (1) During the first quarter of 2024, the Company reorganized certain reporting units and its segment reporting structure. As a result of the reorganization of divisions within PSG and AMG, the prior-period amounts have been reclassified to conform to current-period presentation. SECOND QUARTER 2024 OUTLOOK

The following table outlines onsemi’s projected second quarter of 2024 GAAP and non-GAAP outlook.

Total onsemiGAAP SpecialItems Total onsemiNon-GAAP Revenue $1,680 to $1,780 million – $1,680 to $1,780 million Gross Margin 44.1% to 46.1% 0.1% 44.2% to 46.2% Operating Expenses $327 to $342 million $14 million $313 to $328 million Other Income and Expense (including interest), net ($12 million) – ($12 million) Diluted Earnings Per Share $0.82 to $0.94 $0.04 $0.86 to $0.98 Diluted Shares Outstanding 436 million 4 million 432 million Original – onsemi

-

onsemi announced the formation of the Analog and Mixed-Signal Group (AMG) which will be led by newly appointed group president, Sudhir Gopalswamy. The group will be focused on expanding onsemi’s portfolio of industry-leading power management and sensor interface devices to unlock an additional $19.3 billion total addressable market and accelerate the company’s growth in the automotive, industrial and cloud end markets.

Additionally, Simon Keeton has been promoted to group president of the Power Solutions Group (PSG). His leadership has been instrumental in delivering more than $4 billion in total revenue last year, while ramping a profitable silicon carbide business that achieved over $800 million in revenue in 2023.

“This organizational alignment builds on our strength in delivering highly differentiated and optimized solutions focused on customer needs,” said Hassane El-Khoury, president and chief executive officer of onsemi. “With Simon and Sudhir’s industry expertise and proven track records, we are setting the foundation for further growth and leadership in intelligent power and sensing technologies.”

AMG specializes in the development of a range of power management ICs and high precision, low power sensor interfaces and communications products. It positions onsemi to become a full suite provider of high efficiency power tree solutions with an expanded portfolio of gate drivers, DC-DC converters, multi-phase controllers, eFuses and more.

The group will continue to extend its leadership in automotive- and industrial-focused sensor interface and communication solutions such as inductive, ultrasonic and medical sensing, as well as single-pair Ethernet and Bluetooth® Low Energy (Bluetooth LE) solutions.

AMG combines the former Advanced Solutions Group (ASG) and Integrated Circuits Division (ICD), previously a part of PSG. Gopalswamy will oversee both AMG and Intelligent Sensing Group (ISG), which together drove nearly $4 billion in revenue for the company last year.

This strategic move accelerates onsemi’s position and will add even more system value for customers by powering every architecture with analog and mixed-signal technologies that enable advanced functionality, higher performance and faster time to market.

onsemi will publish its first quarter 2024 earnings based on the reorganized business segments and provide comparable historical data.

Original – onsemi

-

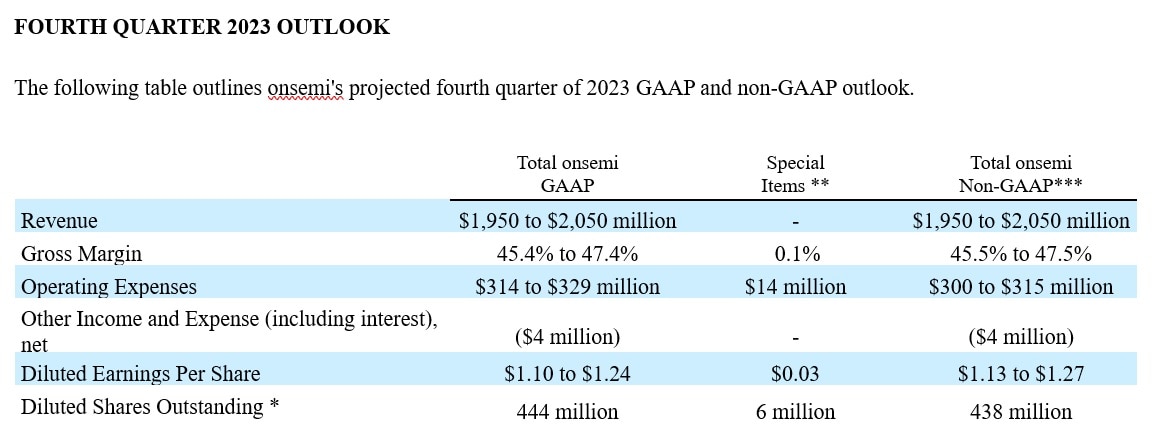

onsemi announced its fourth quarter and fiscal year 2023 results with the following highlights:

- Fourth quarter revenue of $2,018.1 million

- Fourth quarter GAAP and non-GAAP gross margin of 46.7%

- GAAP operating margin and non-GAAP operating margin of 30.3% and 31.6%, respectively

- GAAP diluted earnings per share and non-GAAP diluted earnings per share of $1.28 and $1.25, respectively

- Full year 2023 record automotive revenue of $4.3 billion increased 29% year-over-year

- Full year 2023 share repurchases of $564 million, representing 140% of free cash flow

“Our momentum continued this past year as we achieved record automotive revenue and 4x year-over-year growth in silicon carbide revenue. We continue to transform the business by building resilience into our model, enabling us to navigate uncertain market conditions and deliver more predictable and sustainable results,” said Hassane El-Khoury, president and chief executive officer of onsemi.

“Our consistent performance has validated our long-term strategy. Looking ahead, we are driving innovation beyond silicon and silicon carbide with our upcoming analog and mixed signal platform to further our leadership in intelligent power and sensing solutions.”

Original – onsemi

-

LATEST NEWS / PROJECTS / Si / SiC / WBG2 Min Read

onsemi opened an application test lab in Piestany, Slovakia, focused on the advancement of system solutions for battery/plug-in hybrid/electric vehicles (xEVs) and energy infrastructure (EI) power conversion systems. The state-of-the-art systems applications lab provides specialized equipment to develop and test next-generation silicon (Si) and silicon carbide (SiC) semiconductor solutions in collaboration with automotive OEMs, Tier 1s and EI providers.

Modern semiconductor devices are essential for highly efficient power conversion in xEV powertrains and charging, as well as applications in renewable energy. The new lab will play a central role in ensuring that the development of future power products results in highly differentiated, value-add solutions tailored to customers’ specific requirements.

The new facility consists of two high-voltage power labs that focus on systems and device level development as well as evaluation of SiC/Si traction inverters and ACDC/DCDC power converters. Laser welding facilities, mechanical clean rooms and workshops further enable fast prototyping and testing of next-generation system solutions.

Evaluation capabilities for the next-generation system solutions include:

- Continuous 24/7 testing

- Internally developed and patented software and hardware solutions to support high-voltage power cycling via space vector modulation (SVM) and sinusoidal pulse width modulation (SPWM)

- High-accuracy logging devices for assessing SiC and Si health and reliability

- Simulation of the harsh conditions faced by inverters during operation, testing liquid-cooled devices at temperatures as low as minus 50 degrees C and up to 220 degrees C

- Wider range of industry-recognized software allows for the programing of FPGAs and ARM microcontrollers on site, as well as qualification testing, data analysis and 3D modeling

Original – onsemi

-

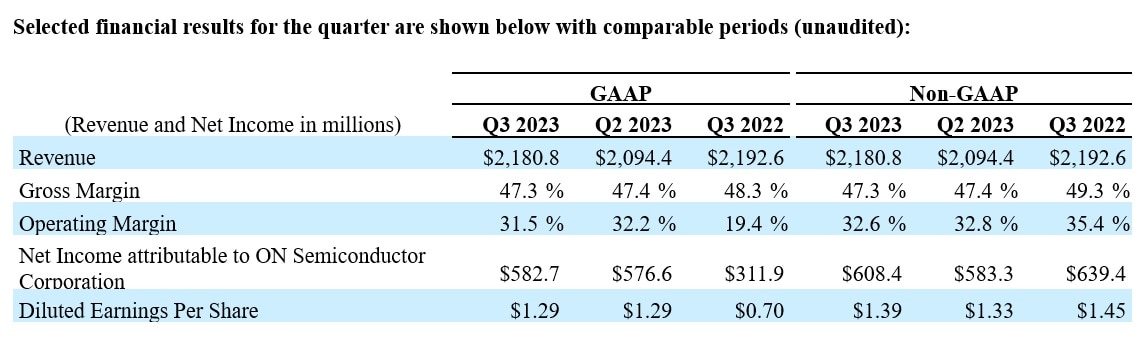

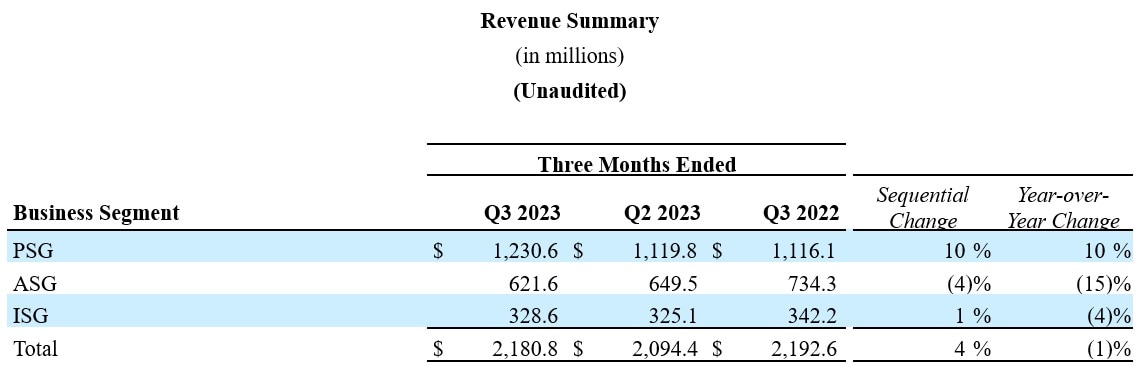

onsemi announced results for the third quarter of 2023 with the following highlights:

- Revenue of $2,180.8 million; GAAP and non-GAAP gross margin of 47.3%

- GAAP operating margin and non-GAAP operating margin of 31.5% and 32.6%, respectively

- GAAP diluted earnings per share and non-GAAP diluted earnings per share of $1.29 and $1.39, respectively

- Record automotive revenue of $1.2 billion, and increased 33% year-over-year

- Record industrial revenue of $616 million, up slightly year-over-year

“Our disciplined approach and execution resulted in another solid quarter, demonstrating the resilience in our business amid market softness,” said Hassane El-Khoury, president and chief executive officer, onsemi.

“We continue to drive structural improvements and efficiencies, most notably in our silicon carbide operation, with the completed expansion of the world’s largest, state-of-the-art silicon carbide fab in South Korea for 150- and 200-millimeter wafers.”

Original – onsemi