-

LATEST NEWS2 Min Read

Wolfspeed announced that Melissa Garrett has been appointed Senior Vice President and General Counsel, effective December 9, 2024. Garrett succeeds Brad Kohn, who has resigned from the company for another professional opportunity.

Garrett brings extensive legal expertise and has served as a senior member of Wolfspeed’s legal team leading global employment and non-patent litigation matters since 2015. She brings a comprehensive legal background in contracts and negotiations, litigation management, corporate governance, employment law, policy and mergers and acquisitions.

“Melissa’s contributions to Wolfspeed over the last nine years have been highly valuable, and we are pleased to welcome her to the role of General Counsel,” said Tom Werner, Executive Chairman. “With her proven track record in legal, risk and compliance, coupled with her deep institutional knowledge of Wolfspeed, she is uniquely qualified to step into this role. We deeply appreciate Brad’s tireless advocacy for Wolfspeed over the years and thank him for his dedication and many contributions to the company. He and Melissa have been working closely on all key projects, so we expect a smooth transition and we wish him all the best in his future endeavors.”

Prior to joining Wolfspeed, Garrett served as Deputy General Counsel and Assistant Corporate Secretary at Kangaroo Express. She previously served as an attorney at Jackson Lewis and Paul, Hastings, Janofsky & Walker LLP, and began her career as an attorney at Fisher & Philips. She holds a Juris Doctor from Indiana University and a Bachelor of Arts from University of Wisconsin-Madison.

Original – Wolfspeed

-

Wolfspeed, Inc. announced its results for the first quarter of fiscal 2025.

Quarterly Financial Highlights (Continuing operations only. All comparisons are to the first quarter of fiscal 2024.)

- Consolidated revenue of approximately $195 million, as compared to approximately $197 million

- Mohawk Valley Fab contributed approximately $49 million in revenue

- Power device design-ins of $1.5 billion

- Power device design-wins of $1.3 billion

- GAAP gross margin of approximately (19)%, compared to approximately 13%

- GAAP gross margin includes the impacts of underutilization costs primarily in connection with the start of production at the Mohawk Valley Fab. Underutilization was $26.4 million as compared to $34.4 million.

- Non-GAAP gross margin of 3%, compared to 16%

- Ended Q1 with ~$1.7 billion in cash and investments; does not include initial draw down of $250 million from lender group

“This quarter we took action to solidify the capital structure, simplifying our business to accelerate structural profitability and support the build out of our state-of-the-art silicon carbide facilities. We will have a 200mm silicon carbide footprint at Mohawk Valley and North Carolina materials factories that we target to generate approximately $3 billion in revenue annually,” said Wolfspeed CEO, Gregg Lowe. “Last month, we reached a significant milestone by signing a non-binding preliminary memorandum of terms (PMT) for up to $750 million in proposed direct funding under the CHIPS and Science Act and an additional $750 million from our lending group, demonstrating substantial progress towards our funding goals. With this announcement, we now have access to up to $2.5 billion of incremental funding to support our U.S. capacity expansion plans.”

Lowe continued, “To drive operational improvements, we are taking action to enhance efficiency, align our business with current market conditions and become the first silicon carbide company to transition to pure-play 200-millimeter. The transition to a fully 200-millimeter platform allows us to take further initiatives to streamline our cost structure, including closing our manual Durham 150-millimeter Fab, other manufacturing footprint rationalization, and reducing our workforce. Combined, we expect these initiatives will yield approximately $200 million in annual cash savings. In parallel, we remain focused on optimizing our capital structure, further reducing our fiscal 2025 CapEx guidance by $100 million to align the pace of our spend with the broader shift in EV market demand.”

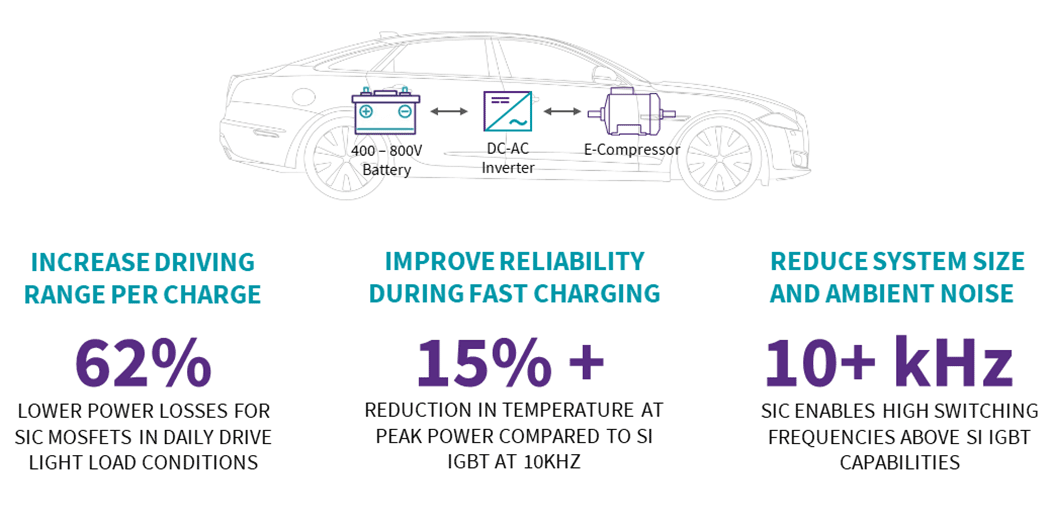

“We delivered 2.5 times year-over-year growth in our automotive business in the first quarter, and we expect our EV revenue to continue to grow throughout calendar 2025, as the total number of car models using a Wolfspeed silicon carbide solution in the power train increased by 4x from 2023 to 2024 and is expected to grow by another approximately 75% year over year in 2025. We also remain confident in the long-term fundamentals of our industrial and energy business. Importantly, we believe the secular trends and long-term growth drivers for our core end markets remain intact, and we expect the actions we are taking today will allow us to become a more efficient and agile organization positioned to capture the long-term growth opportunities ahead,” concluded Lowe.

For its second quarter of fiscal 2025, Wolfspeed targets revenue from continuing operations in a range of $160 million to $200 million. GAAP net loss is targeted at $401 million to $362 million, or $3.14 to $2.84 per diluted share. Non-GAAP net loss is targeted to be in a range of $145 million to $114 million, or $1.14 to $0.89 per diluted share.

Targeted non-GAAP net loss excludes $256 million to $248 million of estimated expenses, net of tax, primarily related to stock-based compensation expense, amortization of discount and debt issuance costs, net of capitalized interest, project, transformation and transaction costs and restructuring and other facility closure costs. The GAAP and non-GAAP targets do not include any estimated change in the fair value of the shares of common stock of MACOM Technology Solutions Holdings, Inc. (MACOM) that we acquired in connection with the sale to MACOM of our RF product line (RF Business Divestiture).

During the first quarter of fiscal 2025, Wolfspeed initiated a facility closure and consolidation plan to optimize its cost structure and accelerate its transition from 150mm to 200mm silicon carbide devices. The costs incurred as a result of this restructuring plan include severance and employee benefit costs, voluntary termination benefits and other facility closure-related costs.

Wolfspeed incurred $87.1 million of restructuring-related costs in the first quarter of fiscal 2025, of which $34.3 million were recognized in cost of revenue, net and $52.8 million were expensed as operating expense in the statement of operations. For the second quarter of fiscal 2025, the Company expects to incur $174 million of restructuring-related costs, of which $34 million will be recognized in cost of revenue, net and the remaining $140 million will be recognized as operating expense.

Original – Wolfspeed

- Consolidated revenue of approximately $195 million, as compared to approximately $197 million

-

Wolfspeed, Inc. announced that Thomas Seifert and Woody Young have been nominated to Wolfspeed’s Board of Directors (the “Board”). Their nominations will be considered by shareholders at the 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”), scheduled for December 5, 2024.

Mr. Seifert has served as the Chief Financial Officer of Cloudflare, Inc., a leading internet security company, since June 2017. Prior to joining Cloudflare, Mr. Seifert held executive leadership positions at a number of technology and semiconductor companies, including serving as Chief Financial Officer of Symantec Corporation, Brightstar Corp., and Advanced Micro Devices Inc. Mr. Seifert currently serves as a member of the Board of Directors of First Derivatives plc, an ultra-high-performance analytics software company.

Mr. Young most recently served as the President and a member of the Board of Directors of Solidigm, a flash memory semiconductor company, from October 2022 until August 2023. Mr. Young has over 30 years of experience as an investment banker and is the former Chairman of Mergers and Acquisitions at Perella Weinberg Partners LP. He previously served as the Co-Head of Global Telecommunications, Media, and Technology at Lazard and in similar roles at Merrill Lynch and Lehman Brothers. Mr. Young currently serves as a member of the Board of Directors of Frontier Communications Parent, Inc. (Nasdaq: FYBR), a fiber internet provider.“We are delighted to nominate Thomas Seifert and Woody Young for election to the Wolfspeed Board of Directors,” said Thomas Werner, Chair of the Wolfspeed Board. Mr. Werner continued, “With yesterday’s CHIPS Act capital structure update, I believe the Company successfully took a key step towards funding the execution of its business plan. We believe Thomas and Woody will be valuable additions to the Board as we focus on executing that plan, driving operational execution improvement, and continuing our previously disclosed efforts to explore ways to enhance shareholder value and unlock Wolfspeed’s strategic value.”

Clyde R. Hosein and John B. Replogle, who have served on the Board since 2005 and 2014, respectively, are not standing for re-election and will retire from the Board following the expiration of their terms at the 2024 Annual Meeting. “On behalf of the Board, I want to thank Clyde and John for their dedication and exemplary service to Wolfspeed over many years,” said Mr. Werner.

Original – Wolfspeed

-

LATEST NEWS5 Min Read

Wolfspeed, Inc. announced its results for the fourth quarter of fiscal 2024 and the full 2024 fiscal year.

Quarterly Financial Highlights (Continuing operations only. All comparisons are to the fourth quarter of fiscal 2023.)

- Consolidated revenue of approximately $201 million, as compared to approximately $203 million

- Mohawk Valley Fab contributed approximately $41 million in revenue

- Power device design-ins of $2.0 billion

- Quarterly design-wins of $0.5 billion

- GAAP gross margin of 1%, compared to 29%

- Non-GAAP gross margin of 5%, compared to 31%

- GAAP and non-GAAP gross margins for the fourth quarter of fiscal 2024 include the impact of $24 million of underutilization costs. See “Start-up and Underutilization Costs” below for additional information.

Full Fiscal Year Financial Highlights (all comparisons are to fiscal 2023)

- Consolidated revenue of approximately $807 million, as compared to approximately $759 million

- GAAP gross margin of 10% as compared to 32%

- Non-GAAP gross margin of 13% as compared to 35%

- GAAP and non-GAAP gross margins for fiscal 2024 include the impact of approximately $124 million of underutilization costs. See “Start-up and Underutilization Costs” below for additional information.

“We have two priorities we are focused on: optimizing our capital structure for both the near term and long term and driving performance in our state-of-the-art, 200-millimeter fab, and this quarter was a step forward on both of these priorities,” said Wolfspeed CEO, Gregg Lowe.

“We achieved 20% utilization at Mohawk Valley in June and continued to see strong revenue growth from that fab. Our 200mm device fab is currently producing solid results, which are at significantly lower costs than our Durham 150mm fab. This improved profitability gives us the confidence to accelerate the shift of our device fabrication to Mohawk Valley, while we assess the timing of the closure of our 150mm device fab in Durham. At the JP, we have also made great progress, installing and activating initial furnaces in the fourth quarter. We have already processed the first silicon carbide boules from the JP and the quality is in line with the high-quality materials coming out of Building 10.

“At the same time, we are taking proactive steps to slow down the pace of our CapEx by approximately $200 million in fiscal 2025 and identify areas across our entire footprint to reduce operating costs. We also remain in constructive talks with the CHIPS office on a Preliminary Memorandum of Terms for capital grants under the CHIPS Act. In addition to any potential capital grants from the CHIPS program, our long-term CapEx plan is expected to generate more than $1 billion in cash refunds from Section 48D tax credits from the IRS, of which we’ve already accrued approximately $640 million on our balance sheet,” continued Lowe.

Business Outlook:

For its first quarter of fiscal 2025, Wolfspeed targets revenue from continuing operations in a range of $185 million to $215 million. GAAP net loss is targeted at $226 million to $194 million, or $1.79 to $1.54 per diluted share. Non-GAAP net loss from continuing operations is targeted to be in a range of $138 million to $114 million, or $1.09 to $0.90 per diluted share.

Targeted non-GAAP net loss excludes $88 million to $80 million of estimated expenses, net of tax, primarily related to stockbased compensation expense, amortization of discount and debt issuance costs, net of capitalized interest, project, transformation and transaction costs and loss on Wafer Supply Agreement.

The GAAP and non-GAAP targets from continuing operations do not include any estimated change in the fair value of the shares of common stock of MACOM Technology Solutions Holdings, Inc. (MACOM) that we acquired in connection with the sale to MACOM of our RF product line (RF Business Divestiture).

Start-up and Underutilization Costs:

As part of expanding its production footprint to support expected growth, Wolfspeed is incurring significant factory start-up costs relating to facilities the Company is constructing or expanding that have not yet started revenue generating production. These factory start-up costs have been and will be expensed as operating expenses in the statement of operations.

When a new facility begins revenue generating production, the operating costs of that facility that were previously expensed as start-up costs are instead primarily reflected as part of the cost of production within the cost of revenue, net line item in our statement of operations. For example, the Mohawk Valley Fab began revenue generating production at the end of fiscal 2023 and the costs of operating this facility in fiscal 2024 and going forward are primarily reflected in cost of revenue, net.

During the period when production begins, but before the facility is at its expected utilization level, Wolfspeed expects some of the costs to operate the facility will not be absorbed into the cost of inventory. The costs incurred to operate the facility in excess of the costs absorbed into inventory are referred to as underutilization costs and are expensed as incurred to cost of revenue, net. These costs are expected to continue to be substantial as Wolfspeed ramps up the facility to the expected or normal utilization level.

Wolfspeed incurred $20.5 million of factory start-up costs and $24.0 million of underutilization costs in the fourth quarter of fiscal 2024. No underutilization costs were incurred in the fourth quarter of fiscal 2023.

For the first quarter of fiscal 2025, operating expenses are expected to include approximately $25 million of factory start-up costs primarily in connection with materials expansion efforts. Cost of revenue, net, is expected to include approximately $24 million of underutilization costs in connection with the Mohawk Valley Fab.

Original – Wolfspeed

- Consolidated revenue of approximately $201 million, as compared to approximately $203 million

-

LATEST NEWS4 Min Read

Wolfspeed, Inc. provided an update on key milestones and an operational update.

Wolfspeed’s Mohawk Valley silicon carbide fab has reached 20% wafer start utilization, a critical step in the Company’s efforts to meet the growing demand for silicon carbide power devices. Additionally, Wolfspeed’s Building 10 Materials facility has achieved its 200mm wafer production target to support approximately 25% wafer start utilization at the Mohawk Valley fab by the end of calendar year 2024. Wolfspeed plans to update the market on its next utilization milestone for Mohawk Valley during its fiscal Q4 2024 earnings call in August.

The Mohawk Valley fab has also achieved LEED (Leadership in Energy and Environmental Design) Silver certification, a distinction from the world’s most widely used green building framework and rating system. The LEED Silver certification highlights Wolfspeed’s enduring commitment to going beyond compliance, promoting environmental health and industry leading sustainability.

This state-of-the-art Mohawk Valley facility is the world’s first purpose-built, fully automated 200mm silicon carbide fab, and when combined with Wolfspeed’s market-leading 200mm materials production, solidifies Wolfspeed’s competitive position as the only fully vertically integrated 200mm silicon carbide manufacturer at scale.

Additionally, Wolfspeed’s John Palmour Manufacturing Center (“the JP”) in Siler City, NC, which will be the world’s largest, most advanced silicon carbide materials facility upon completion, has installed and recently activated initial furnaces less than one year after vertical construction commenced. As a result, the facility is on schedule to achieve crystal qualification by early August 2024. This meaningful progress reinforces the Company’s confidence that it is well-positioned to ramp the JP in line with its target to deliver wafers from the facility to Mohawk Valley by the summer of 2025.

Wolfspeed also announced that it experienced an equipment incident at its Durham 150mm device fab that resulted in a temporary capacity reduction while the incident was being remediated. Production has been resumed and the Company expects that the Durham 150mm device fab’s capacity utilization can return to previously targeted levels by August. As a result of the production disruption, the Company does not expect an impact on fourth quarter revenue, but does expect to have an underutilization impact and incur other costs in the fourth quarter as described below.

“Having reached our 20% utilization target at Mohawk Valley, we are well-positioned to continue executing our 200mm vertical integration strategy ahead of other market participants,” said Gregg Lowe, president and CEO of Wolfspeed. “Further, recent advancements at the JP put Wolfspeed well on track to achieve our facility targets and significantly expand our materials capacity, driving meaningful progress towards our strategic goals. We quickly identified and resolved an equipment incident at our Durham 150mm device fab, and we continue to focus on execution as we move with urgency to continue this first-of-its-kind ramp.”

Business Outlook

Based on the Durham 150mm device fab equipment incident, Wolfspeed is updating its fiscal fourth quarter 2024 guidance as follows, and providing a preliminary outlook on fiscal first quarter 2025 revenue and non-GAAP gross margin:

- Targeted fiscal fourth quarter revenue from continuing operations is unchanged at $185 million to $215 million; and a potential negative impact to fiscal first quarter 2025 revenue of approximately $20 million.

- Targeted fourth quarter GAAP gross margins in the range of (4%) to 4% and non-GAAP gross margins in the range of 0% to 8%, due to an underutilization impact realized in the fourth quarter and other fourth quarter costs related to the equipment incident. The Company also expects fiscal first quarter 2025 non-GAAP gross margins in a similar range due to underutilization it will realize in the period.

- Fourth quarter GAAP net loss from continuing operations is targeted at $204 million to $182 million, or $1.61 to $1.44 per diluted share. Non-GAAP net loss from continuing operations is targeted to be in a range of $122 million to $105 million, or $0.96 to $0.83 per diluted share. Targeted non-GAAP net loss from continuing operations excludes $77 million to $82 million of estimated expenses, net of tax, primarily related to stock-based compensation expense, amortization of discount and debt issuance costs, net of capitalized interest, project, transformation and transaction costs and loss on Wafer Supply Agreement.

Original – Wolfspeed

-

Wolfspeed, Inc. announced its results for the third quarter of fiscal 2024.

Quarterly Financial Highlights (Continuing operations only. All comparisons are to the third quarter of fiscal 2023):

- Consolidated revenue of approximately $201 million, compared to approximately $193 million

◦ Mohawk Valley Fab contributed approximately $28 million in revenue, over a 2x increase from the prior quarter

◦ Materials revenue of approximately $99 million – second highest quarter on record - Power device design-ins of $2.8 billion

- Quarterly design-wins of $0.9 billion – 70% related to EV applications

- GAAP gross margin of 11%, compared to 31%

- Non-GAAP gross margin of 15%, compared to 34%

◦ GAAP and non-GAAP gross margins for the third quarter of fiscal 2024 include the impact of $30 million of underutilization costs, representing approximately 1,500 basis points of gross margin. See “Start-up and Underutilization Costs” below for additional information.

“We are pleased with the significant operational milestones achieved in the quarter for Wolfspeed as we continue to be the world’s first fully, vertically integrated 200-millimeter silicon carbide player at scale,” said Wolfspeed CEO, Gregg Lowe.

“We are making progress on our Mohawk Valley ramp, more than doubling revenue sequentially in the quarter and reaching more than 16% wafer start utilization in April, giving us confidence in our ability to achieve our 20% utilization target in June 2024. Construction continues at the JP, our 200mm materials factory in North Carolina. During the quarter, we started installing furnaces and connected the facility to the power grid, and we recently hosted our topping out ceremony. As we’ve said before, Mohawk Valley will be the flywheel of growth for Wolfspeed, and the JP will be instrumental in supplying it with high-quality materials. We are encouraged by the operational progress these facilities have made and how it will support our long-term growth trajectory.”

Lowe continued, “While there have been headlines around general demand weakness in EVs, we still have more demand than we can supply for the foreseeable future. Our second highest quarter of design-ins to date and more than $5 billion of designwins so far this fiscal year, tell a compelling story. While the industrial and energy end markets pose short-term headwinds to our results, we firmly believe in the strength of our long-term prospects as the electrification of all things continues across a broad set of applications.”

Original – Wolfspeed

- Consolidated revenue of approximately $201 million, compared to approximately $193 million